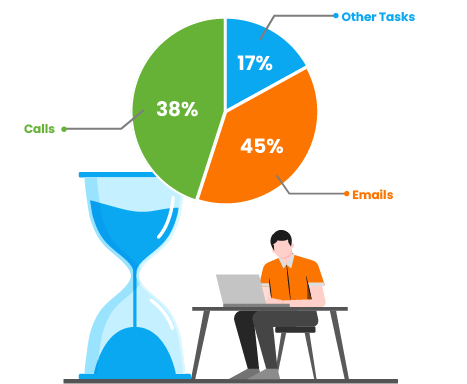

In the role of a collections analyst, communication via emails and phone calls constitutes a significant portion of daily tasks. Understanding the variety of communications and how AI can optimize these interactions is crucial for enhancing efficiency and effectiveness.

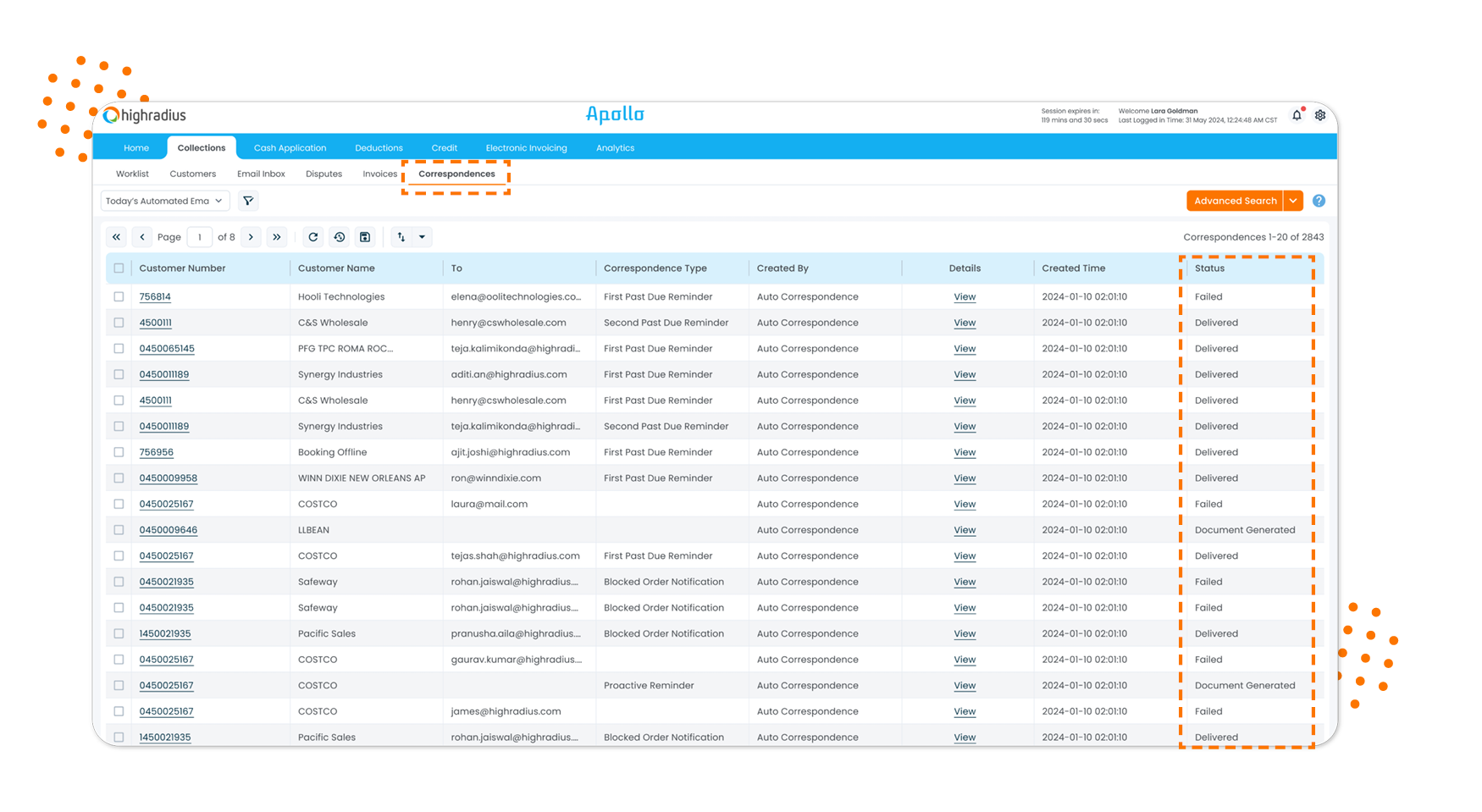

Email Automation

Types of Emails

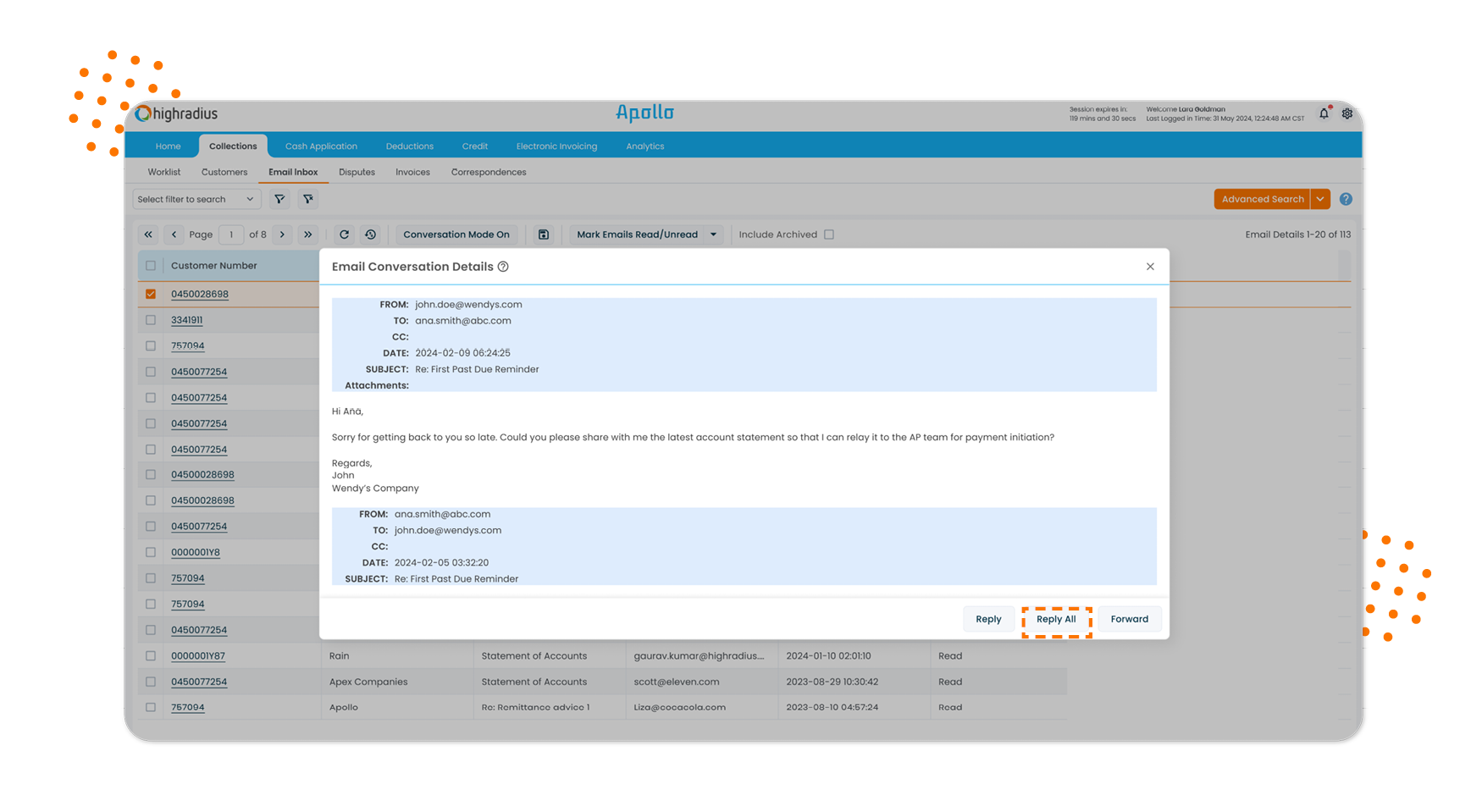

Collections analysts handle a diverse range of email types each day, including:

- Account Statement Requests: Customers often request statements to review their transaction history.

- Invoice PDF Requests: Specific details or copies of invoices are frequently requested for verification or processing.

- Payment Confirmations: Confirmation emails are sent to acknowledge the receipt of payments.

- Disputes: Dispute emails involve clarification requests or errors in billing that need resolution.

- General Follow-Ups: Regular follow-ups to ensure timely payments or to maintain communication lines.

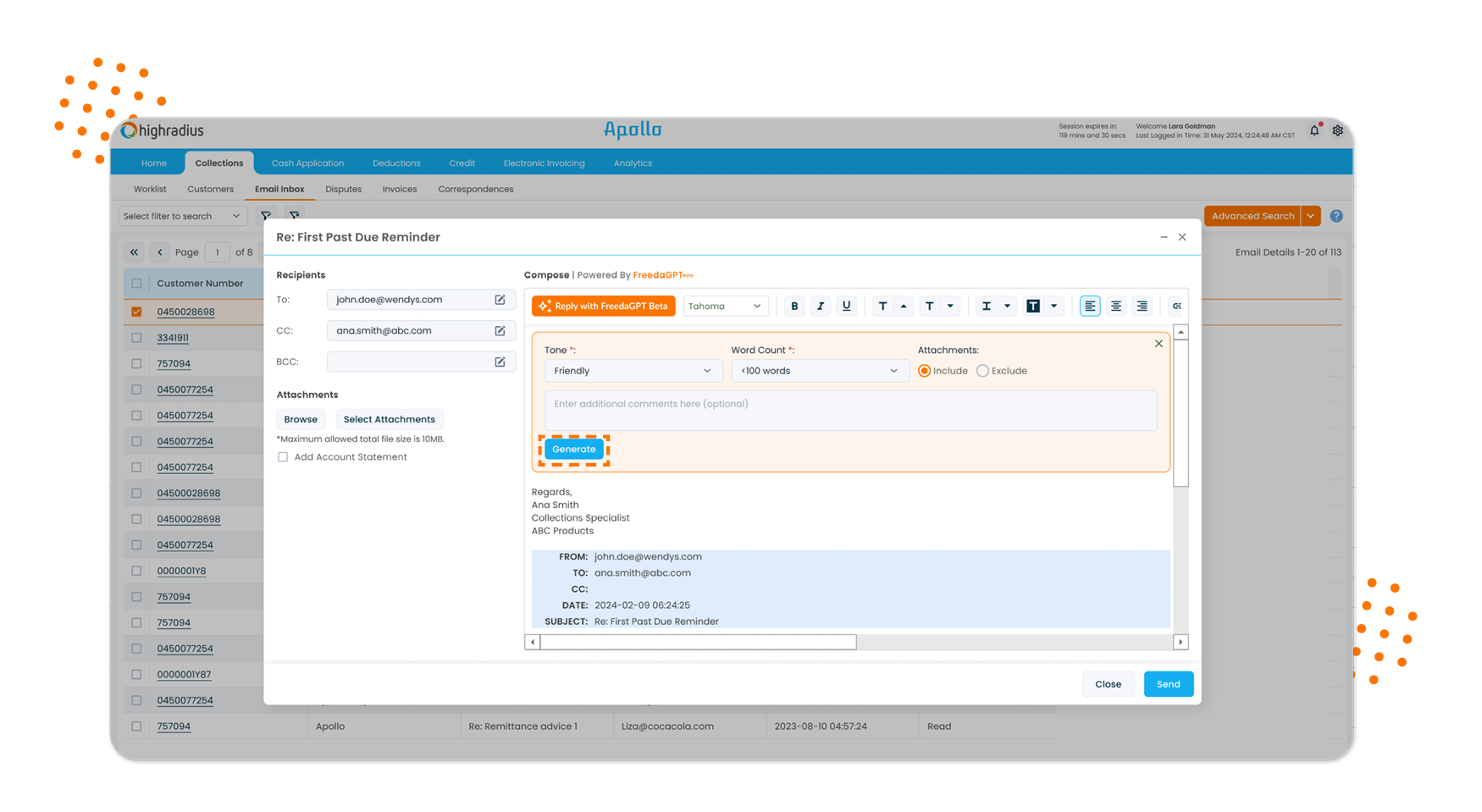

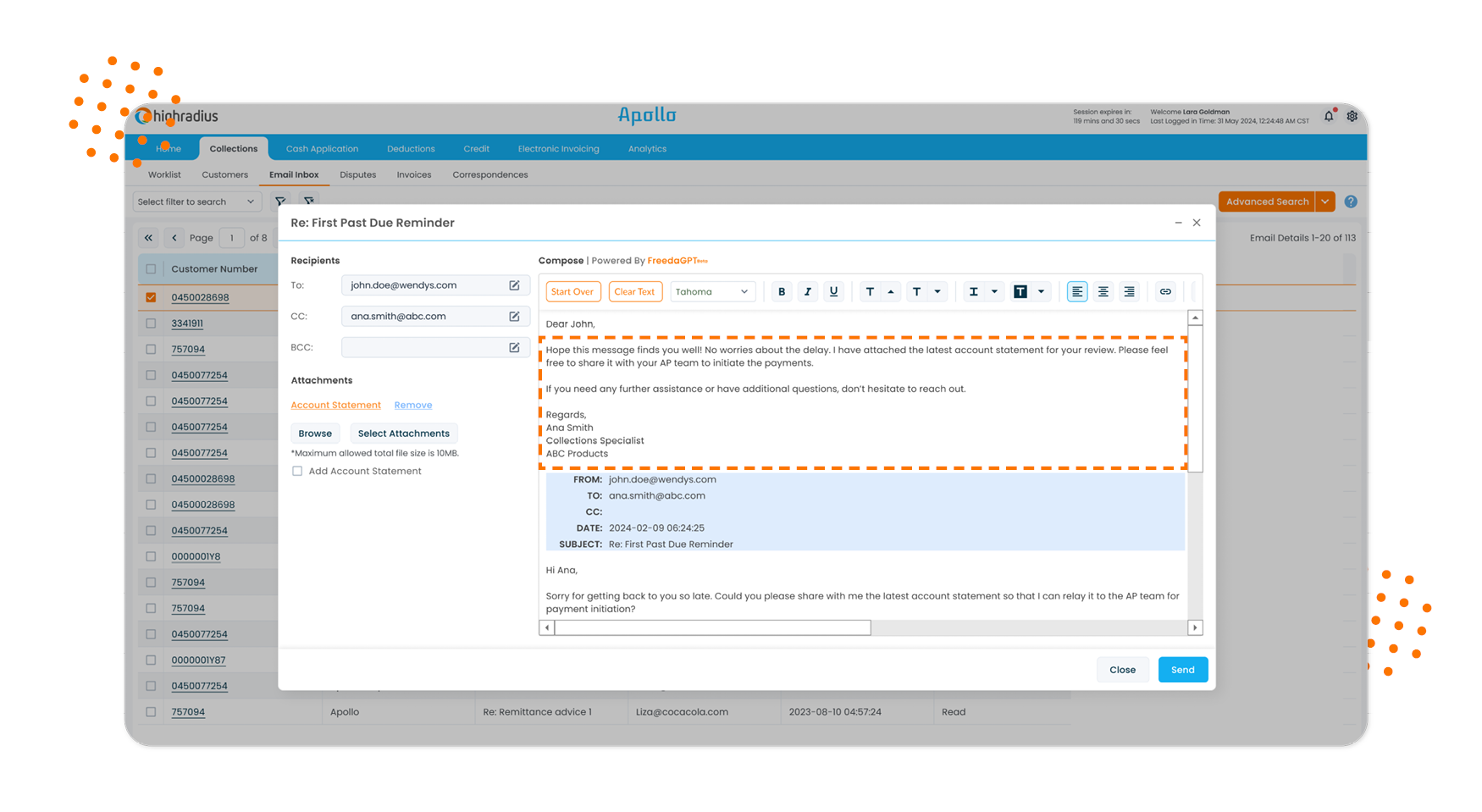

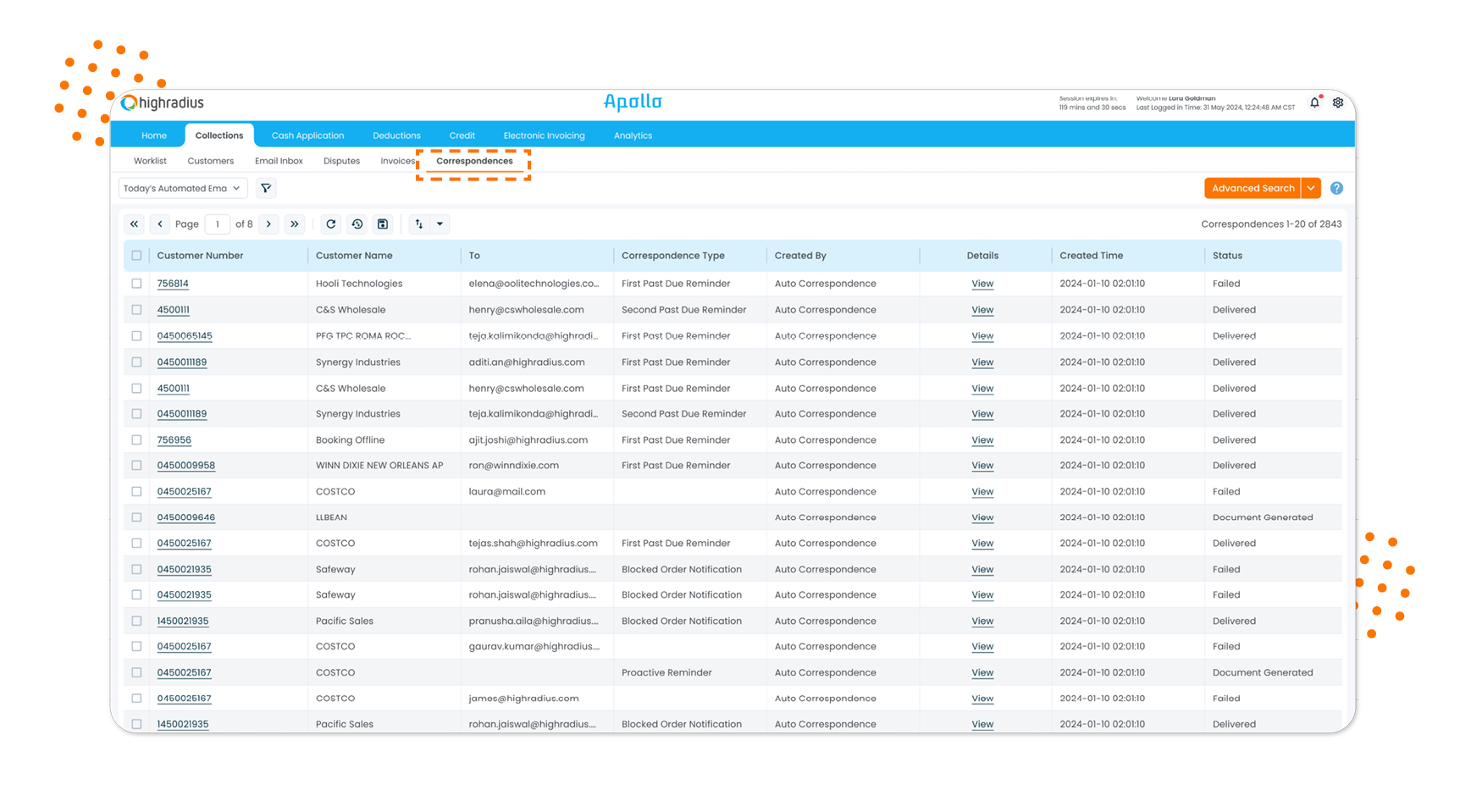

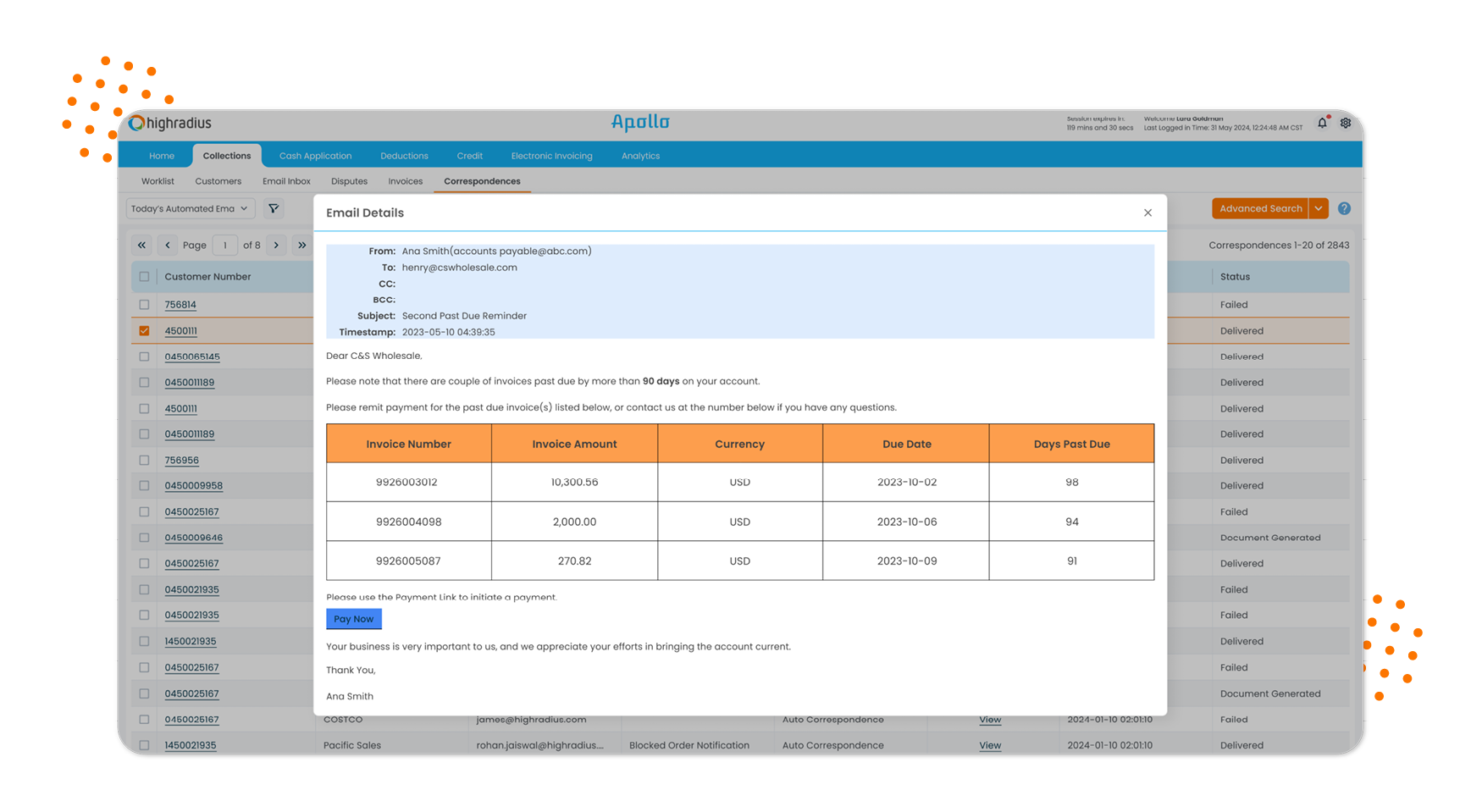

AI in Email Handling

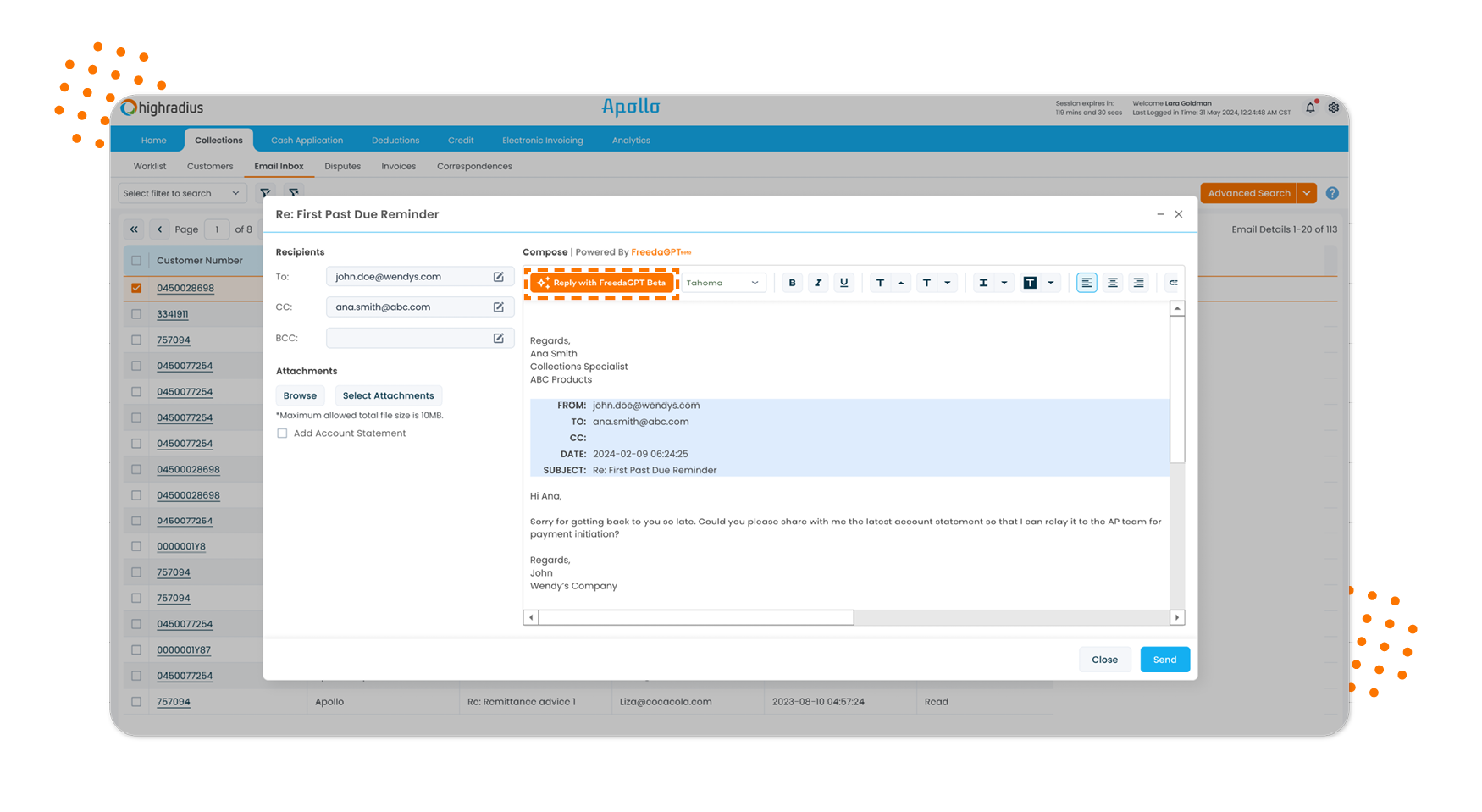

AI significantly streamlines email management by automating responses to routine inquiries. For instance, when a request for an account statement or invoice is received, AI systems can automatically:

- Draft a response confirming receipt of the request.

- Identify and retrieve the relevant documents.

- Attach these documents to the email and send them to the customer without manual intervention.

- Log the interaction for future reference, ensuring no request goes untracked.

This automation reduces the time analysts spend on routine email tasks, allowing them to focus on more complex issues that require human judgment and interaction.

Call Prioritization and Assistance

Preparation

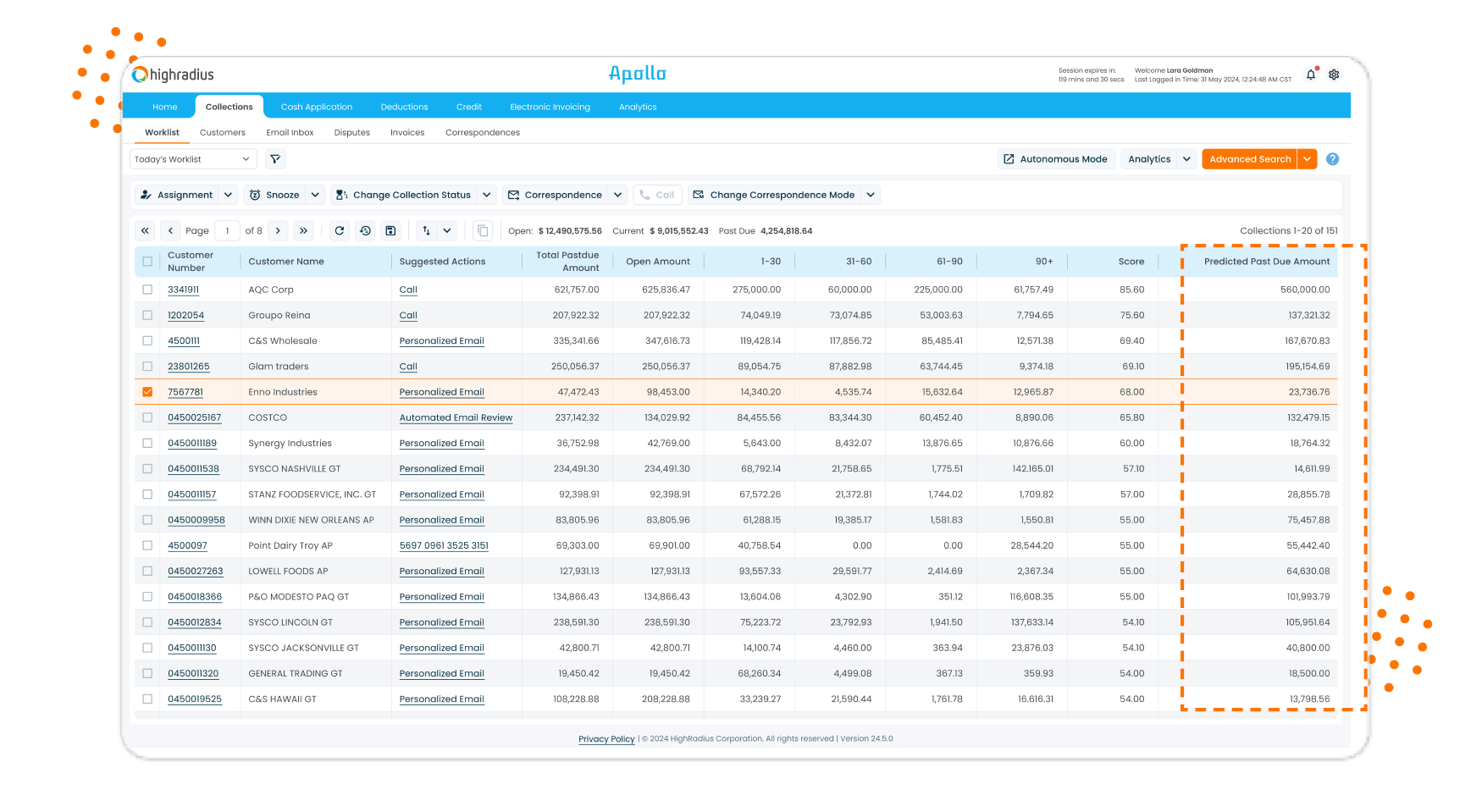

Before even picking up the phone, AI helps analysts by:

- Prioritizing Customers for Calls: AI analyzes payment history and account status to prioritize which customers should be called first.

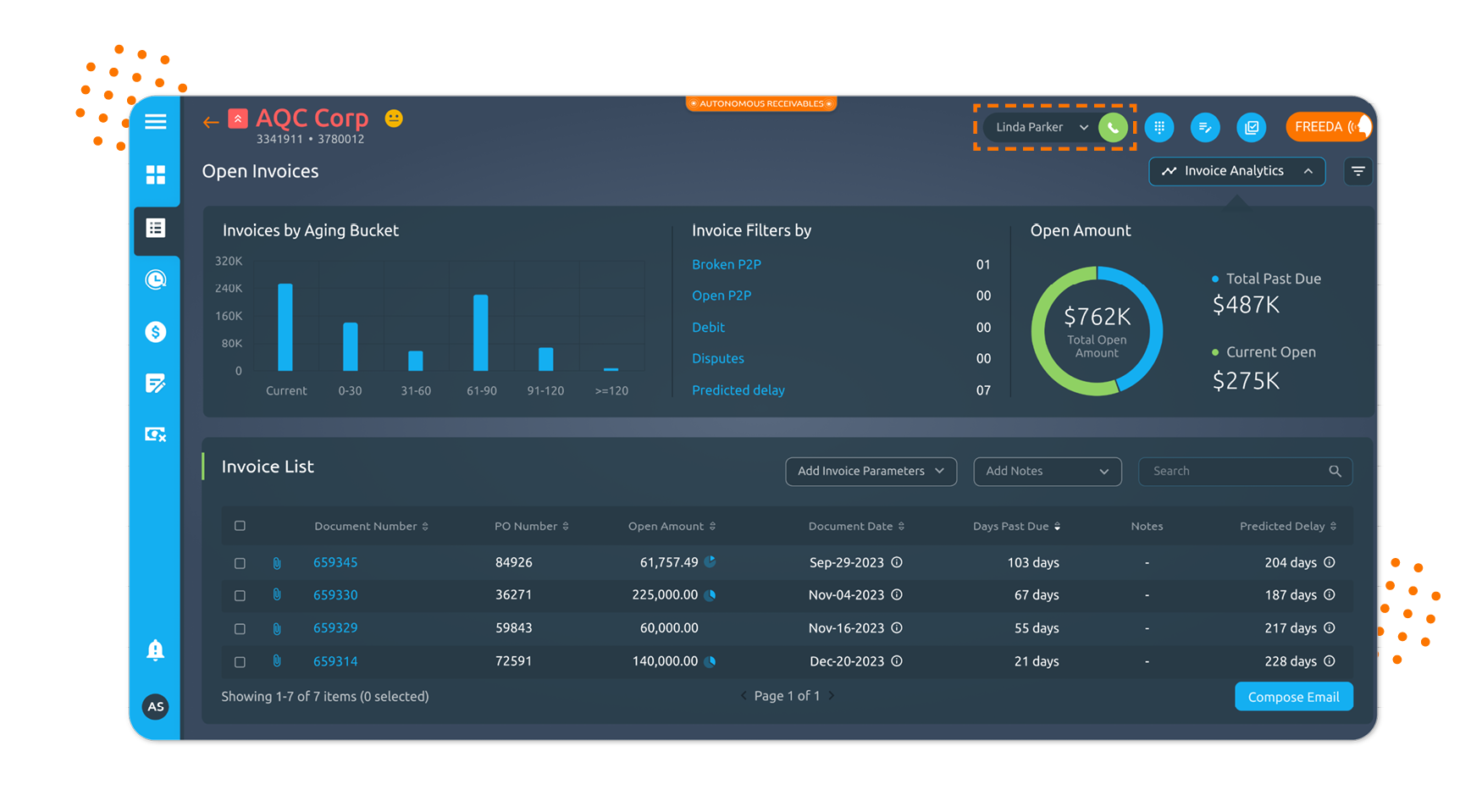

- Understanding Communication History: Quick access to previous interactions aids in personalized and informed communication.

- Conducting Customer Account Reviews: AI tools quickly compile relevant account information, helping prepare for productive discussions.

During the Call

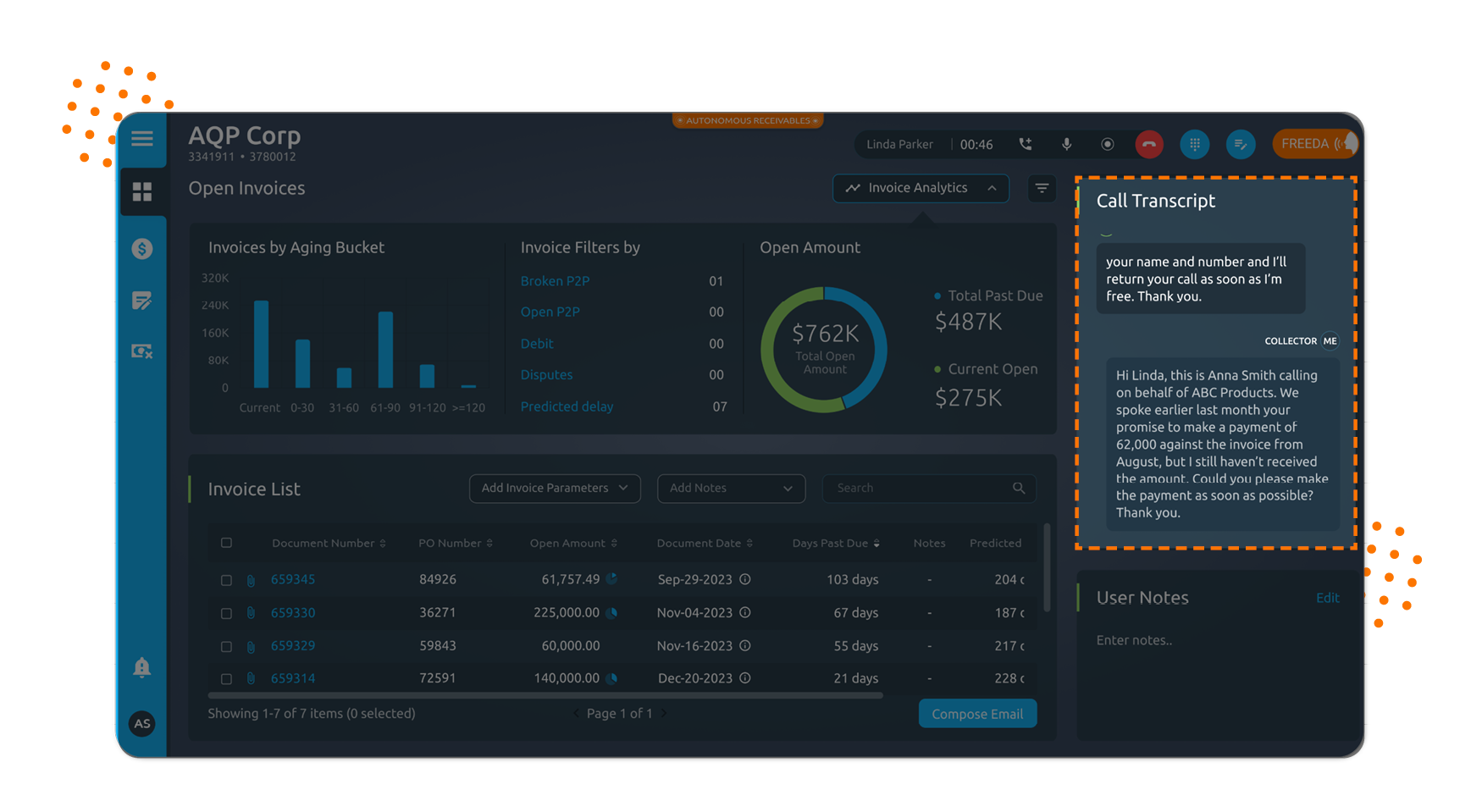

While on the call, AI continues to assist by:

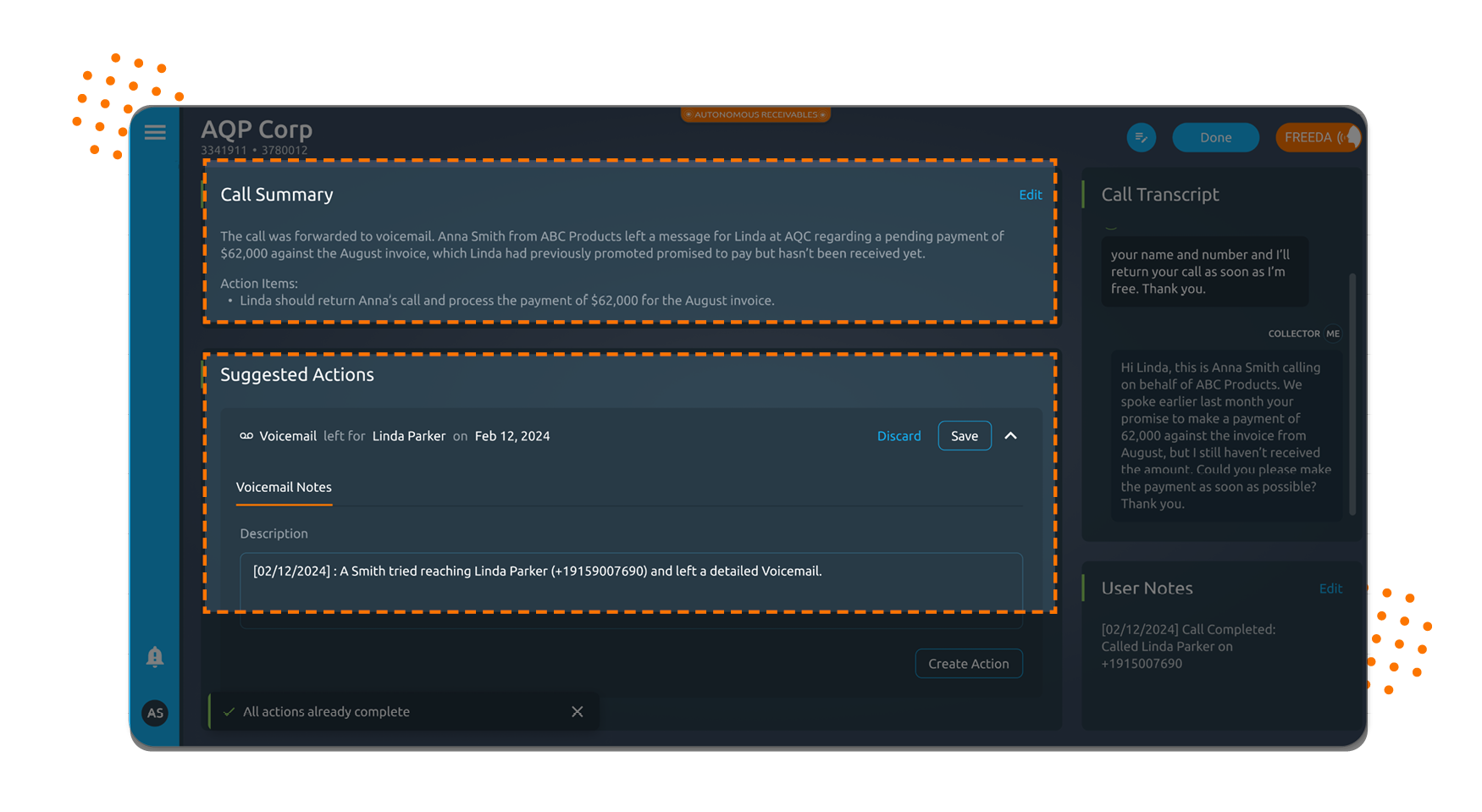

- Taking Notes: AI can transcribe conversations in real time, ensuring that all details are captured accurately.

- Searching for Invoices and Relevant Information: AI systems provide quick access to needed documents during the conversation, reducing hold times and improving customer satisfaction.

Post-Call Actions

After the call, AI enhances follow-up efficiency by:

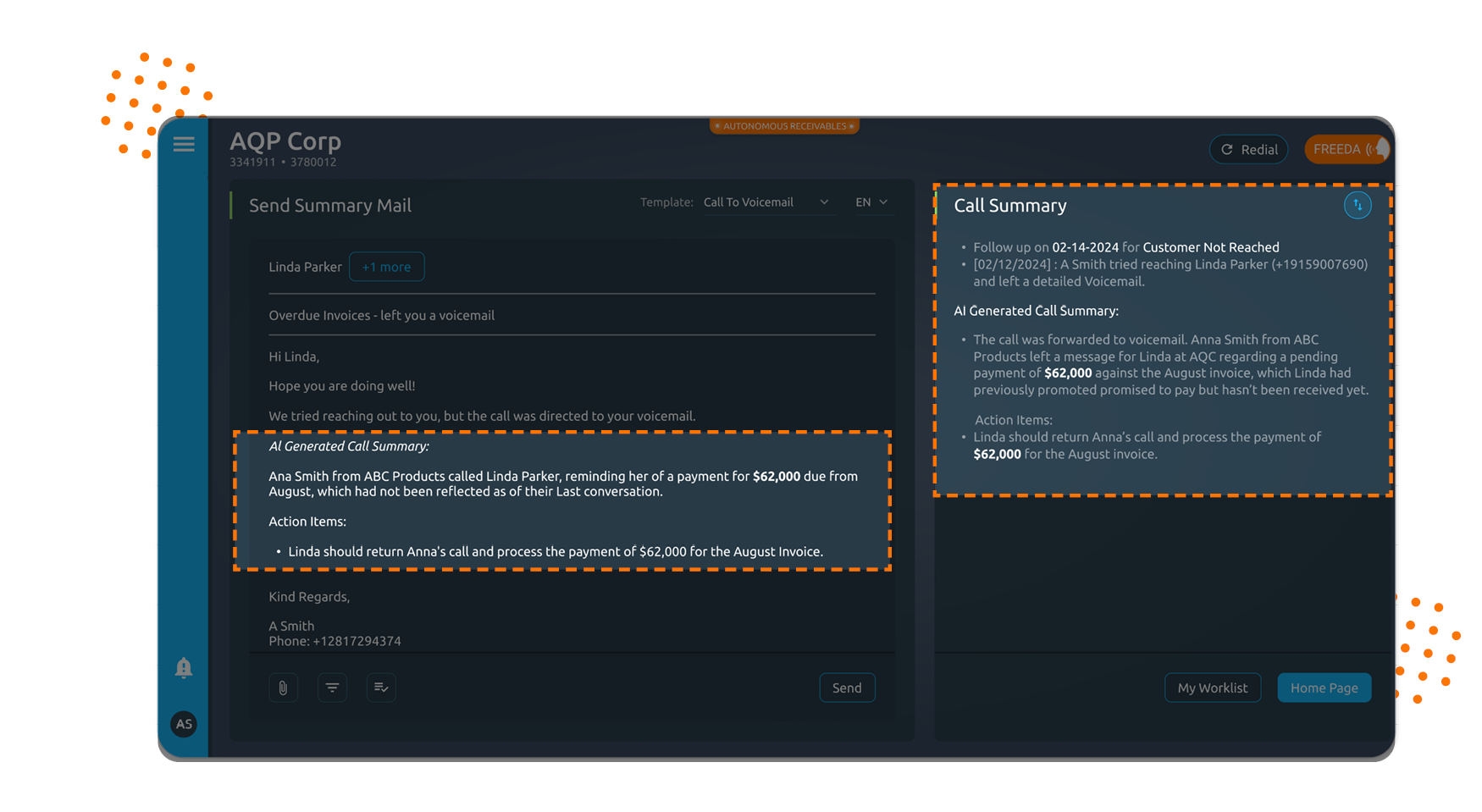

- Sending Summary Emails: Automatically generated emails that summarize the call and confirm any agreements or actions can be sent, ensuring clarity and commitment.

- Creating Action Items: AI can help log action items directly into the collections system, such as promises to pay (P2P), dispute resolutions, and follow-up tasks.

By integrating AI into these communication processes, collections analysts can ensure that each customer interaction is as efficient and effective as possible. This not only improves the operational efficiency but also enhances customer relations by providing timely, accurate, and personalized service.