Executive management views successful projects as either making money, saving money,

or strengthening an existing initiative. Persuasive arguments for technology investments should be framed in these terms. Unfortunately, departments often attempt to convince management to fund automation projects based upon statements such as these:

Each one of these “rationales” for bringing in an automated system carries with it an element of subjectivity which can be negated either through more objective thinking or a difference of opinion. For example, the complaint of being stretched thin will most likely be countered by a statement of “you need to do a better job of managing the workload across your department.”

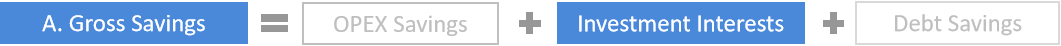

CFOs are often the primary decision maker and are concerned with how to “do more with less.” This translates into two important performance indicators:reducing costs and

increasing cash flow.

In the following chapters, we break down each of these components and analyze how they contribute to a winning business case.

To get started, benchmark your current Operational Expenditures (OPEX) and set a target goal of the savings you’ll realize with a solution.

Step 1 Identify Process Tasks

The cash forecasting process tasks vary between companies. In general, they depend on the

size of the company and the organizational structure of the finance department.

Step 2 Calculate Time Spent

Review the current process and identify how many hours per week on average your team

spends on each task. This gives you the total FTEs your team expends on forecasting cash over a given period.

Step 3 Forecast Time Savings

A Sample hourly breakdown of tasks and average hour savings with automation is shown below:

Step 4 Calculate Final OPEX Savings

To calculate OPEX savings multiply the hours saved per week by the loaded labor costs.

With accurate cash forecasting powered by AI, companies can reduce variance significantly and earn interest by investing proactively.

With reduced variance in forecasts, companies don’t need to borrow as much from external sources and hence, don’t have to pay interest associated with borrowing.

As per these calculations, automating cash forecasting with Artificial Intelligence can influence the bottom-line significantly.

Capital expenditure (CAPEX) is the one-time expense for implementation. It consists of hardware costs and software costs.

Hardware Costs for On-premise Projects

Hardware Costs for SaaS Projects

Software Costs for On-premise Projects

Software Costs for SaaS Projects

Operational expenditure (OPEX) is the ongoing costs for running a process. OPEX includes the money spent on regular maintenance of the IT infrastructure. It consists of subscription fees and IT maintenance costs.

Subscription Fees:A periodic (monthly, yearly, or seasonal) fee to gain access to the product or service. It typically includes the licence, support, and other fees.

IT Maintenance Costs for On-premise Applications

IT Maintenance Costs for SaaS Applications

Low Capital Expenditure with Software-as-a-Service Model

Low Operational Expenditure with Zero IT Maintenance Cost

High Gross Savings Leading to Low Payback Time

Visit highradius.com/treasury for free assessment

HighRadius offers you a FREE Value Assessment Service to see how automation and

increased accuracy can benefit your organization. In this analysis, HighRadius will perform a methodical evaluation of your current state (‘as-is’) across your people, process and technology.

At the end of the value assessment you will be armed with a mapped current process and

time spent, the new ‘future-state’ model and flow diagrams, a gap-analysis including

high-level requirements, and a ROI model for project implementation.

Benefits Include:

Automate cash forecasting and cash management with our AI-powered Treasury suite and experience enhanced end-to-end cash flow visibility

Talk to our experts