Mid-market CFOs, traditionally considered number crunchers and financial risk managers, are facing a new era. As organizations rely on CFOs as strategic executives crucial to corporate planning and decision-making, the role is altering substantially.

CFOs will continue to be responsible for fundamental duties such as budgeting, financial reporting, and cash flow management. However, simply being the organization’s financial steward is no longer sufficient. The modern CFO is expected to contribute strategic ideas to the C-suite while creating and carrying out the business’s strategic plan and facilitating transformation across the entire organization. For many financial professionals, this meant acquiring new skills for the digital age.

Technology advancements and easy access to vast volumes of data, both inside and outside the organization, are changing the function of the modern CFO. They must take the initiative in implementing these new technologies and serve as transformational leaders who manage the speed of change across the organization. Those that succeed in doing this will be able to make data-driven decisions, which will help their organizations become more effective, successful, and agile.

With half the time of traditional processes, new technologies like APIs, Machine Learning algorithms, and Artificial Intelligence enable finance teams to find fresh insights that no human could ever anticipate. Digitization influenced to CFOs to:

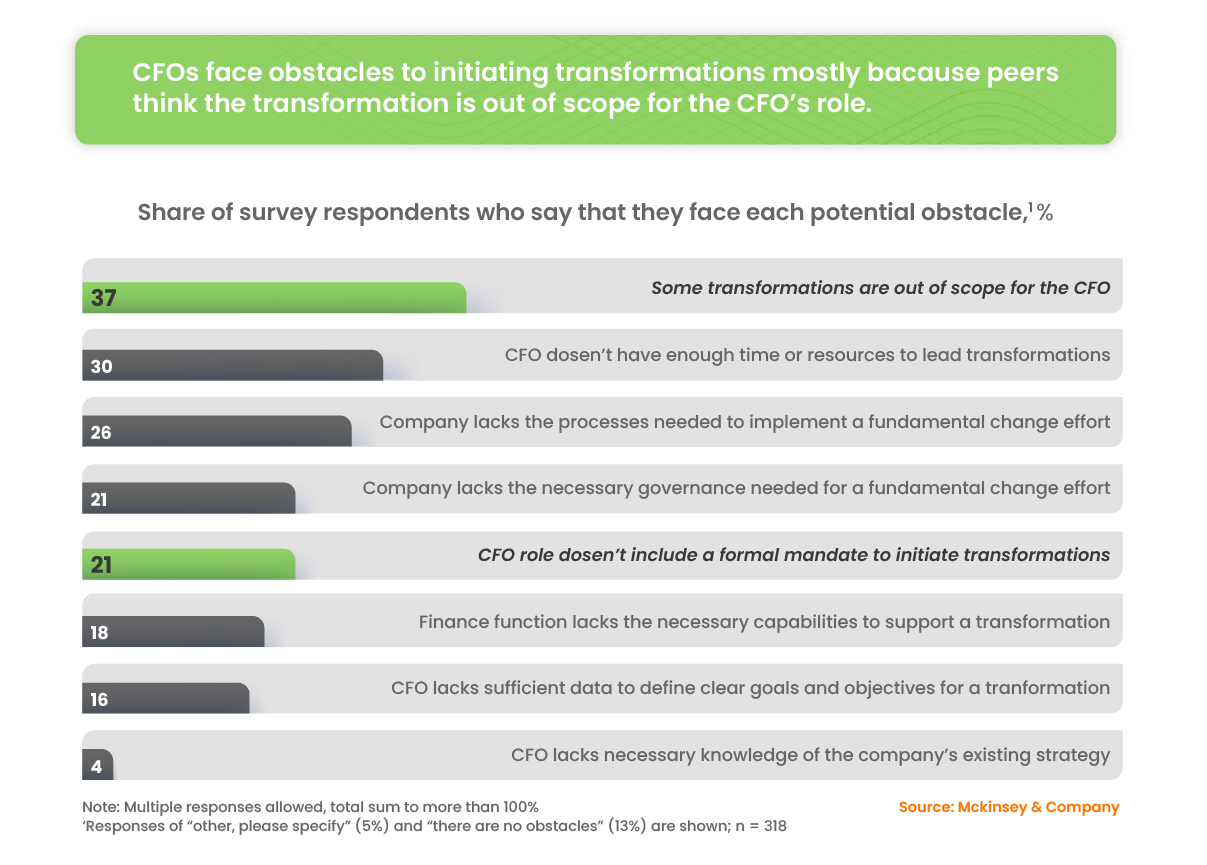

Despite the influence digital transformation has on finance and treasury, many CFOs cannot initiate the transformation due to some bottlenecks, which are discussed below.

According to the survey by Mckinsey & Company, CFOs are facing problems initiating transformations because some transformations are out of the scope of the CFO and also because they don’t have enough time and resources to lead the transformation.

These are the best practices for CFOs to initiate and accelerate digital transformation:

For example, a specialized team could use data augmented with artificial intelligence to speed up data collection and preparation and discover and visualize discoveries, all without the need to create models or write algorithms.

To plan, companies must digitize their financial and treasury activities. To digitally transform operations, CFOs must lead the implementation to digitally transform operations by considering the questions below.

Before CFOs make their decision, they may want to consider the following questions:

For example: How will this technology implementation allow the CFO to make more informed decisions?

For example:

For example:

Treasury teams should have a system to keep tabs on expenses and gains during the solution. If the value outweighs the expected cost of a treasury management system, the business should consider going forward with the investment.

A treasury cloud-based software can improve treasury processes and provide scalability and flexibility per a company’s needs. But these benefits can be obtained when the goals of the CFO are aligned with the software’s USPs.

For an organization to profit greatly from treasury software, it’s critical to match the advantages with the CFO’s objectives, such as:

Although most people are aware of the apparent advantages, the following holistic benefits that can help the CFO’s case are as follows:

On average, our clients have saved 48+ hours per month by automating their bank data aggregation and standardization.

Here’s a customer case study that states how a global wholesale distributor with a revenue of $37B with operations across America, EMEA, and APAC overcame their challenges with our software.

They were facing these challenges:

With HighRadius’ AI-Powered Cash Forecasting Software, they were able to:

With HighRadius’s Treasury Management Software, CFOs will be able to have access to the following:

Automate cash forecasting and cash management with our AI-powered Treasury suite and experience enhanced end-to-end cash flow visibility

Talk to our experts