AI is not just about automating repetitive tasks—it offers a more intelligent, predictive, and adaptable system that continually improves the reconciliation process.

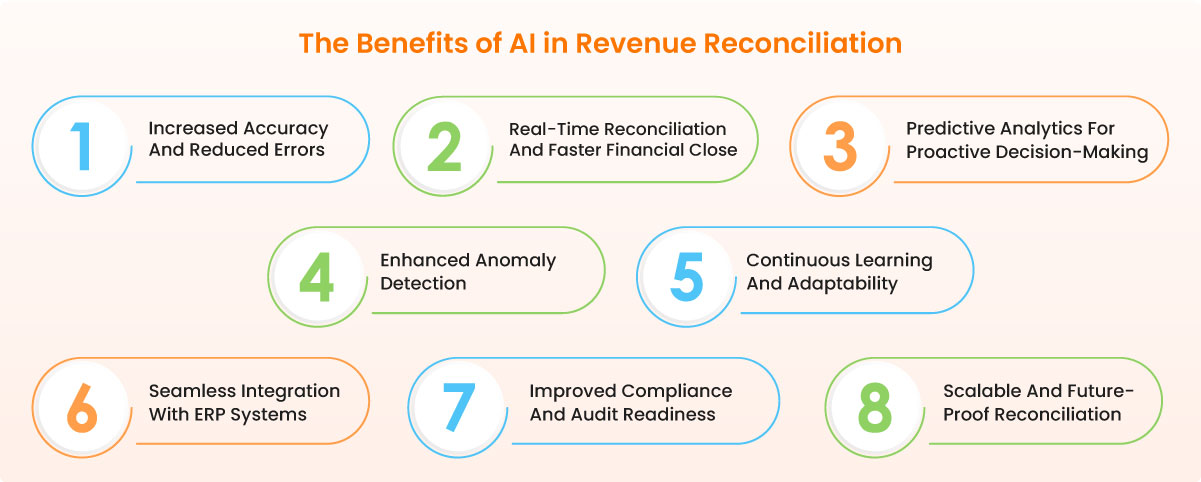

1. Increased Accuracy and Reduced Errors

Manual revenue reconciliation processes are prone to errors, especially when dealing with large volumes of data, multiple revenue streams, and complex payment models like commissions and royalties. AI significantly reduces the risk of human error by automating critical tasks, such as:

- Transaction Matching: AI algorithms quickly and accurately match transactions from different systems, such as POS systems, bank records, and ERP data.

- Error Detection and Resolution: AI can spot discrepancies that would otherwise be missed by human reviewers. It also suggests corrective actions, ensuring that errors are fixed before they impact financial statements.

By minimizing the reliance on manual processes, AI increases accuracy and ensures that your financial data is consistent and reliable. This leads to cleaner financial records, which are essential for audits and compliance reporting.

2. Real-Time Reconciliation and Faster Financial Close

One of the most significant benefits of AI in revenue reconciliation is speed. Traditional reconciliation processes often slow down the financial close, as finance teams manually match transactions, investigate discrepancies, and correct errors. AI, on the other hand, can perform these tasks in real time, allowing enterprises to:

- Achieve Faster Financial Closes: With AI, reconciliation tasks that typically take days or weeks can be completed in hours or minutes. This allows finance teams to close the books faster and reduce the month-end workload.

- Provide Real-Time Financial Insights: AI enables real-time reconciliation, so enterprises have up-to-date financial records at all times. This gives CFOs and financial controllers a clearer picture of the company’s financial health, enabling more timely and informed decision-making.

Faster reconciliation means that enterprises can respond more quickly to financial challenges and opportunities, improving agility in today’s fast-paced business environment.

3. Predictive Analytics for Proactive Decision-Making

AI-driven predictive analytics is one of the most powerful features in modern revenue reconciliation. By analyzing historical data and learning from past patterns, AI systems can:

- Anticipate Future Discrepancies: AI algorithms can forecast where discrepancies are likely to occur in the future based on past trends, allowing finance teams to take proactive steps to address these issues before they arise.

- Optimize Cash Flow Management: Predictive analytics can help finance teams forecast revenue trends, manage working capital, and improve cash flow by identifying potential bottlenecks in revenue recognition.

With AI, revenue reconciliation becomes a proactive, forward-looking process. Enterprises can plan ahead, identify risks early, and make better strategic decisions based on reliable financial forecasts.

4. Enhanced Anomaly Detection

In complex enterprises with multiple franchises, outlets, or revenue streams, discrepancies are often buried deep within large datasets, making them difficult to spot. AI excels at anomaly detection by continuously monitoring data patterns and identifying outliers. This offers several benefits:

- Improved Fraud Detection: AI can flag unusual transactions that deviate from established patterns, helping enterprises catch potential fraud before it becomes a larger issue.

- Identifying Data Entry Errors: AI algorithms detect and flag unusual patterns in transaction records that may indicate data entry mistakes, allowing finance teams to correct these errors quickly.

AI-based anomaly detection ensures that issues are identified and resolved in real time, minimizing the risk of financial misstatements and ensuring that your records remain clean and accurate.

5. Continuous Learning and Adaptability

Unlike static, rule-based reconciliation systems, AI-powered solutions are dynamic and continuously improve over time. Using machine learning (ML), AI systems:

- Learn from Historical Data: AI models get smarter with each reconciliation cycle. As the system processes more data, it learns from past reconciliations and applies this knowledge to improve accuracy in future cycles.

- Adapt to Changing Business Conditions: AI systems are capable of adjusting to new revenue streams, changes in payment models, or evolving financial regulations. As business conditions change, AI systems can quickly recalibrate and ensure that the reconciliation process remains efficient and accurate.

This continuous learning process not only improves the reconciliation accuracy but also allows AI systems to remain flexible and adaptable, evolving in step with the business’s growth and changes.

6. Seamless Integration with ERP Systems

While traditional ERP systems provide a strong foundation for managing core financial processes, they often struggle with the complexities of revenue reconciliation. AI-driven tools, such as HighRadius Account Reconciliation, seamlessly integrate with existing ERP systems, enhancing their capabilities. The integration offers the following benefits:

- Elimination of Silos: AI ensures that data from multiple sources, including POS systems, CRMs, and billing systems, is consolidated and reconciled in a unified process.

- Enhanced Data Flow: AI-driven reconciliation platforms allow for faster data transfers between ERP systems and external financial sources, improving data visibility and accuracy.

- Automation Across Systems: By connecting disparate financial systems, AI can automate reconciliation across all revenue streams, no matter how complex the data sources are.

This seamless integration reduces the complexity and manual effort associated with managing multiple financial systems, ensuring a more streamlined and efficient reconciliation process.

7. Improved Compliance and Audit Readiness

Enterprises are under increasing pressure to comply with evolving accounting standards like ASC 606 and IFRS 15. AI can help enterprises stay compliant by automating revenue recognition processes and ensuring that all transactions are accurately recorded and reconciled. Key compliance benefits include:

- Automated Audit Trails: AI-driven reconciliation systems automatically generate audit trails that track every transaction, correction, and adjustment made during the reconciliation process. This transparency ensures that enterprises are always audit-ready.

- Regulatory Alignment: AI systems are designed to stay up-to-date with the latest accounting regulations, ensuring that revenue reconciliation processes align with current compliance requirements.

By providing accurate and complete financial records, AI enhances an enterprise’s ability to pass audits smoothly, avoid penalties, and maintain regulatory compliance.

8. Scalable and Future-Proof Reconciliation

As enterprises grow, their financial operations become more complex. AI-driven revenue reconciliation systems are built to scale with the enterprise, ensuring that growth does not outpace the capabilities of the financial team. The key scalability benefits of AI include:

- Handling Large Transaction Volumes: AI systems can process and reconcile thousands (or even millions) of transactions across multiple revenue streams and outlets, making them ideal for large enterprises with high transaction volumes.

- Supporting Expansion: Whether an enterprise expands through acquisitions, new franchises, or new revenue models, AI systems can easily adapt and scale to meet these growing needs.

With AI, enterprises can future-proof their revenue reconciliation processes, ensuring that they are prepared for growth, complexity, and changing financial landscapes.