Finance leaders are optimistic about the future. In our survey earlier this year, 65% of mid-market finance leaders mentioned that they expect their 2025 revenues to grow by more than 20% YoY. Though a recession is imminent, most business leaders are confident about positive economic growth in the next three years.

Businesses that are invested in technology are likely to be more optimistic about growth prospects than technology laggards. And the ones that focus on building customers’ confidence in their use of artificial intelligence (AI), cybersecurity, and data protection capabilities are 1.6 times more likely than the global average to achieve at least 10% revenue and EBIT (earnings before income tax) growth.

The pandemic accelerated the use of digital tools, enabling businesses to achieve higher growth figures when the markets rebounded. There are still several more processes that can be streamlined and improved. Finance teams continuously need to revamp, innovate, and transform digitally to prepare for the future.

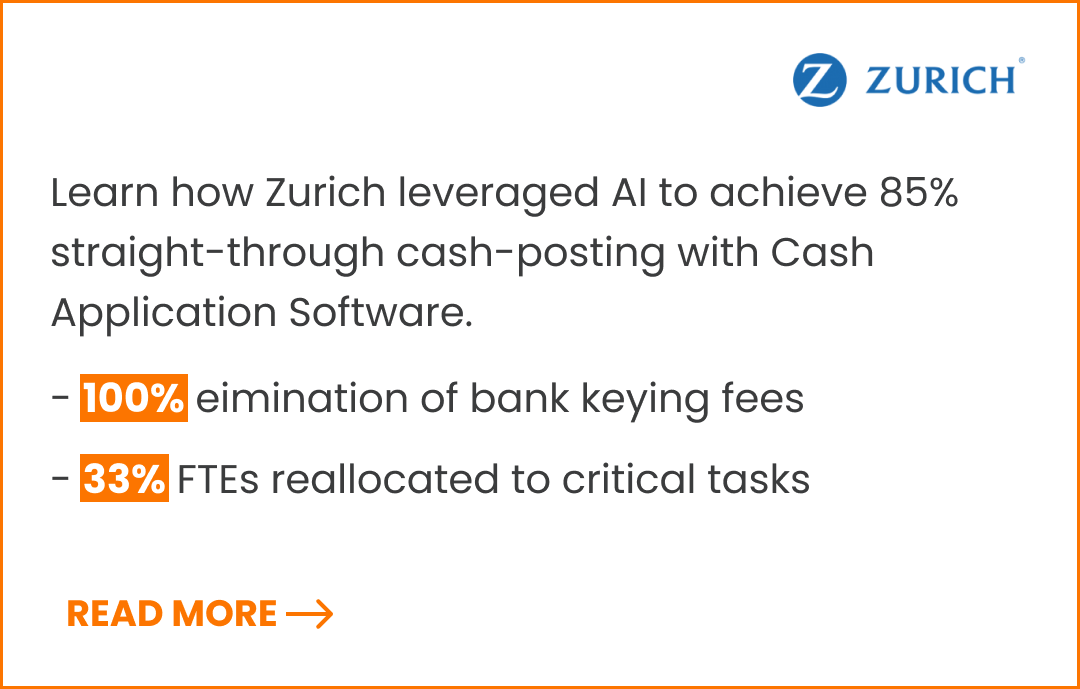

Our clients have reported phenomenal cost reductions, efficiency, and productivity improvements after embracing HighRadius’ autonomous solutions for accounting, receivables management, and treasury operations.

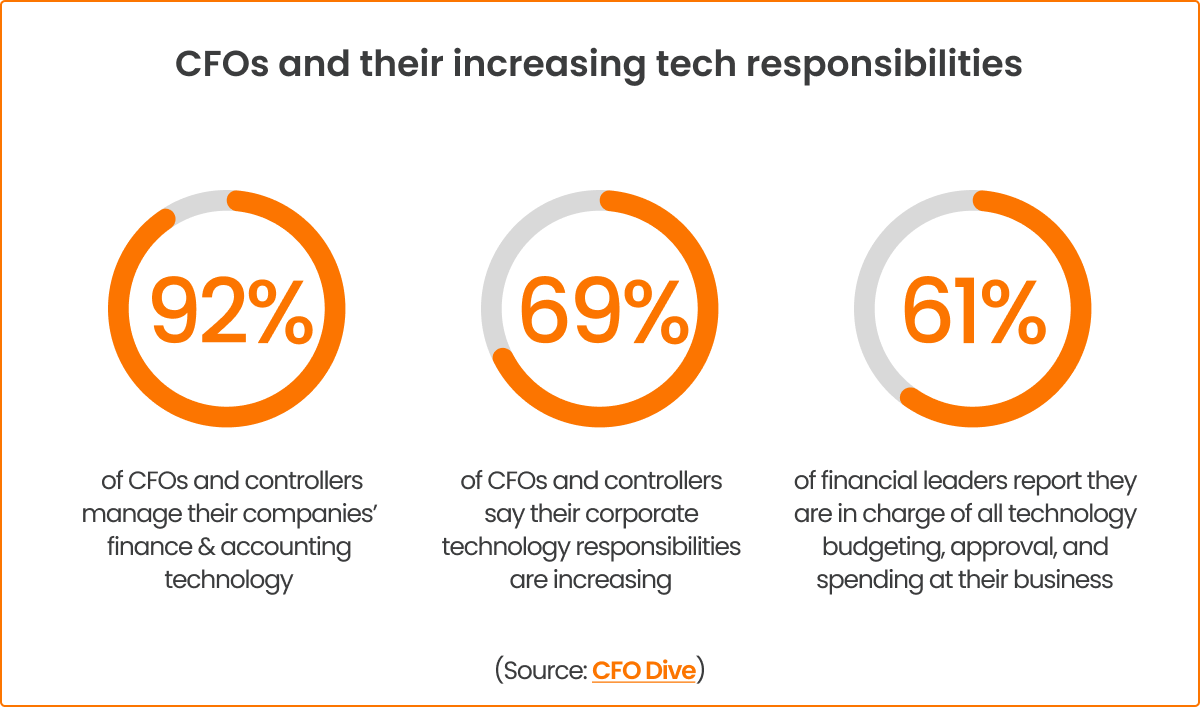

Finance leaders, especially in mid-sized businesses, are investing in technologies to gain a competitive advantage and expand their businesses. It’s because the finance function of the future will be a more strategic partner that helps businesses achieve their goals rather than being only an accounting and reporting function.

Very soon the finance department will be transformed with the use of autonomous solutions that combine multiple technologies such as robotic process automation (RPA), AI, natural language processing (NLP), internet of things (IoT), digital twins, etc. to complete processes with little to no human involvement.

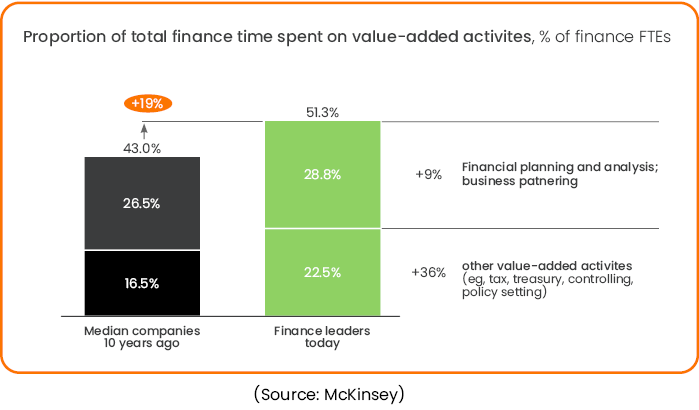

The time saved with automation tools will enable finance & accounting (F&A) associates to focus on strategic initiatives such as driving innovation, building sustainable businesses, improving data management and strategy, fighting money laundering, and strengthening cybersecurity.

Modern finance leaders will be brand ambassadors of their organizations as they begin to have more direct interactions with investors, shareholders, customers, and partners. They’ll also be partners in talent retention and delivering great customer experiences.

The future of finance is thus a broader canvas that’ll see the collaboration between machines (algorithms) and humans to complete daily operations. From simply automating low-end jobs such as data entry, machines will drive high-end automation to support better decision-making.

Now is the time to look at the future of finance and prepare for it. Each chapter in the eBook covers a particular dimension of the future of finance. Let’s take a look at how the world of finance will look 5-10 years from now.