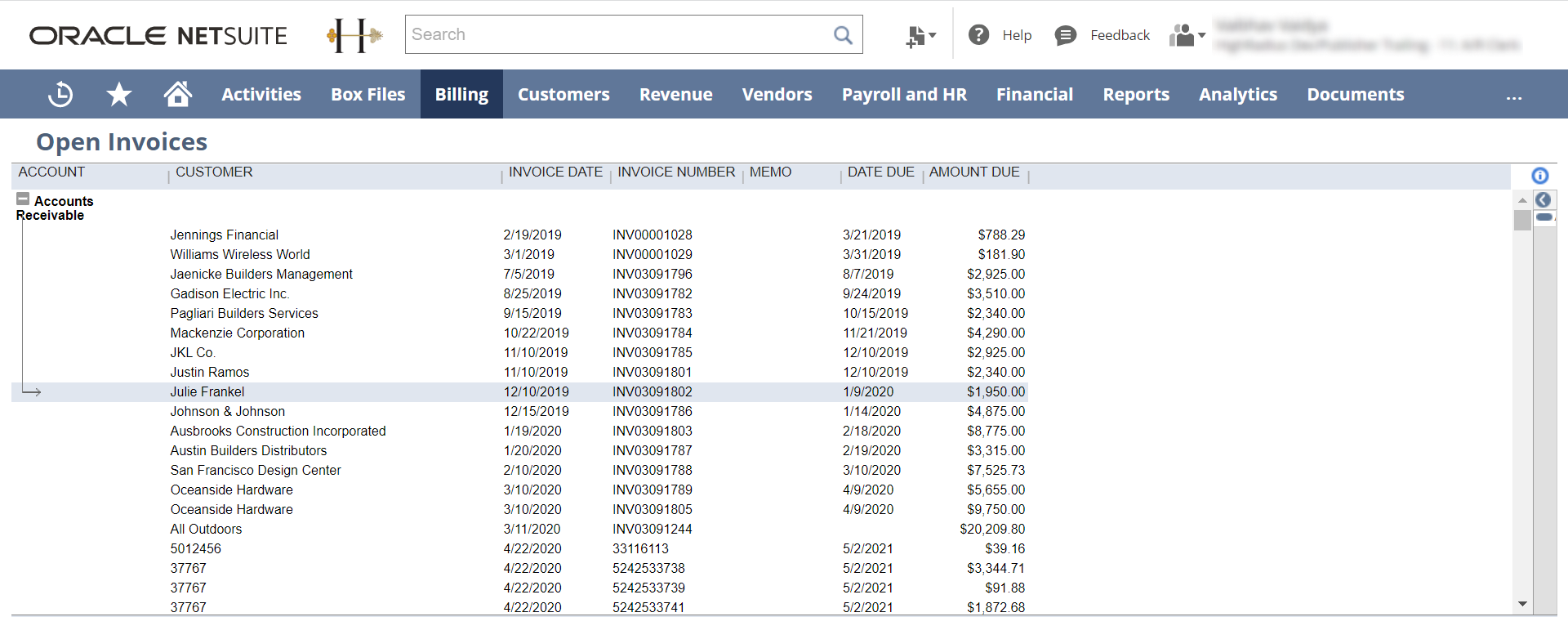

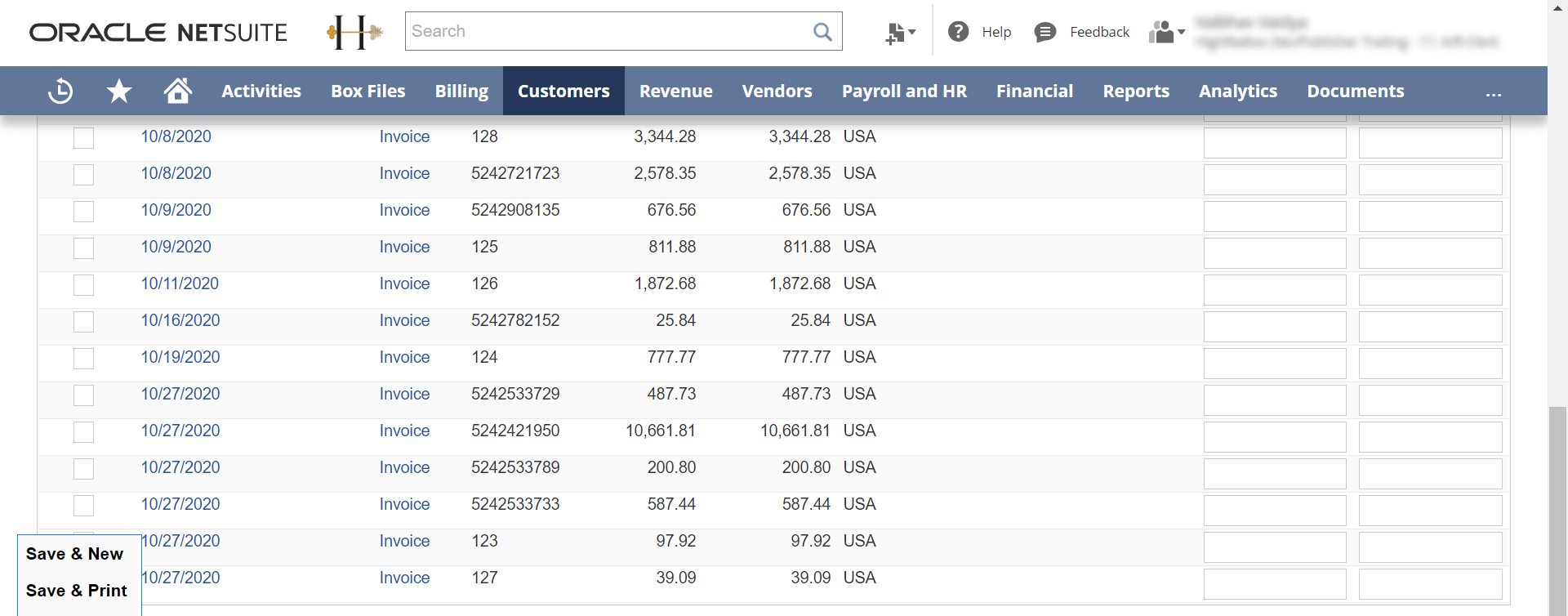

Let’s take a brief look at how the cash application process is done in NetSuite .

It starts with the user manually searching for invoices from a list of all open invoices. Then the remittance information is tracked down and applied against the same.

How remittance aggregation works for different payment channels in NetSuite :

Checks

In order to process check payments, Netsuite users usually integrate with third party solutions for OCR features. This adds additional costs and risks to the project.

Email

NetSuite AR users have to read the email body or open the email attachments to collate remittance information and manually update the data against the invoices. Hence, the time taken for remittance capture increases along with an increased chance of errors. This leads to delayed cash application and customer dissatisfaction.

Web portals

Netsuite requires additional integration with web portals to extract remittance information. The implementation and maintenance has to be handled separately, thus increasing overheads.

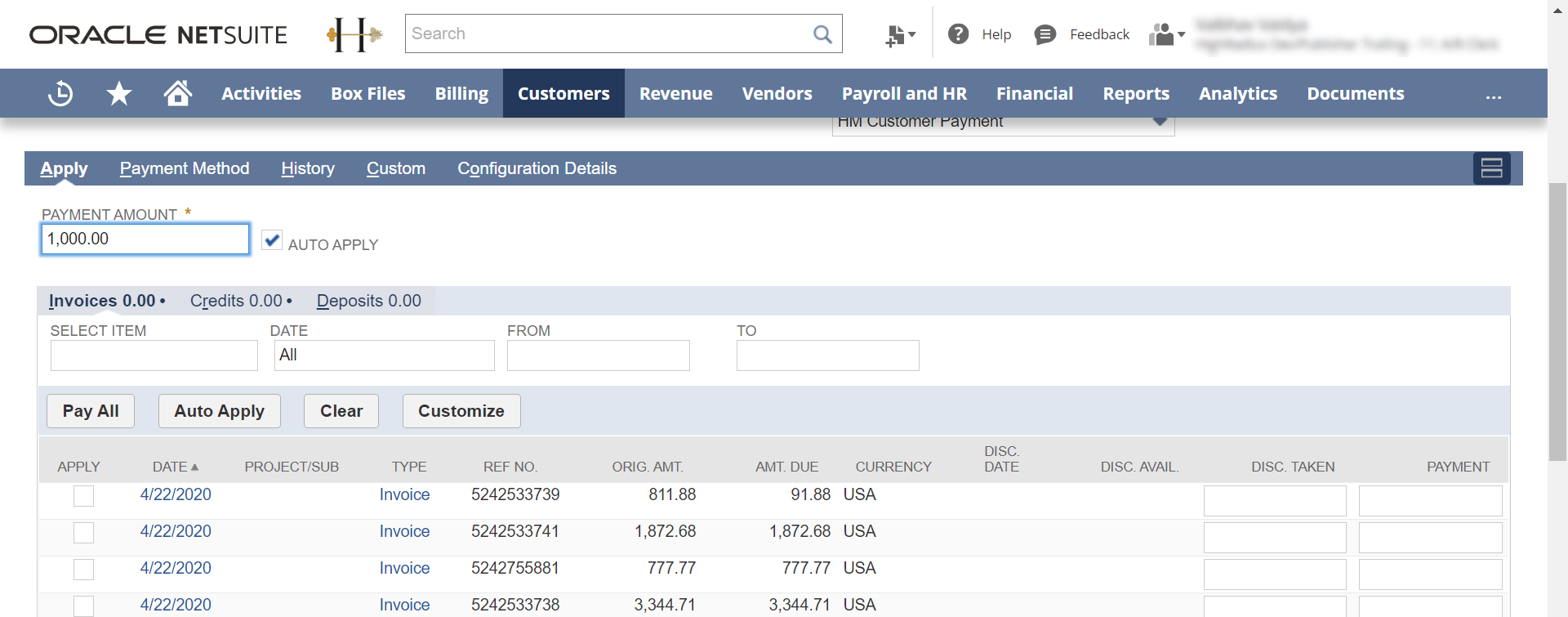

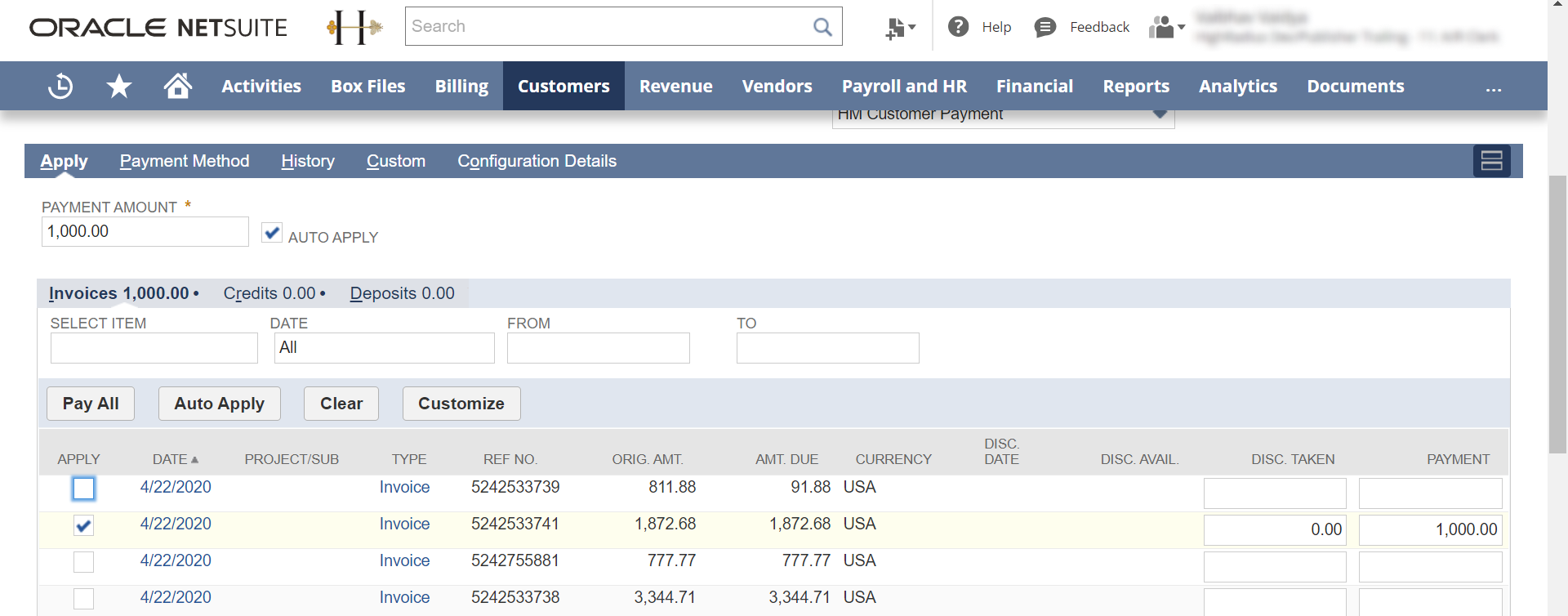

Once cash is applied, the next crucial function is deductions. Deduction management, like cash application, is often a very manual and time intensive process.

In NetSuite, the AR team has to check with their customer manually about the payment being a partial or a short payment. Based on the communication from their customers, the AR team will generate an additional credit note for the adjustment. In the case of it being a valid deduction, the analyst has to manually select the appropriate reason code in NetSuite.