Implementing Smarter and Quicker Borrowing Decisions with Cash Forecasting Software

Treasury teams play a pivotal role in driving financial returns by overseeing the execution of strategies to meet financial goals. They can make or break a business in turbulent times.

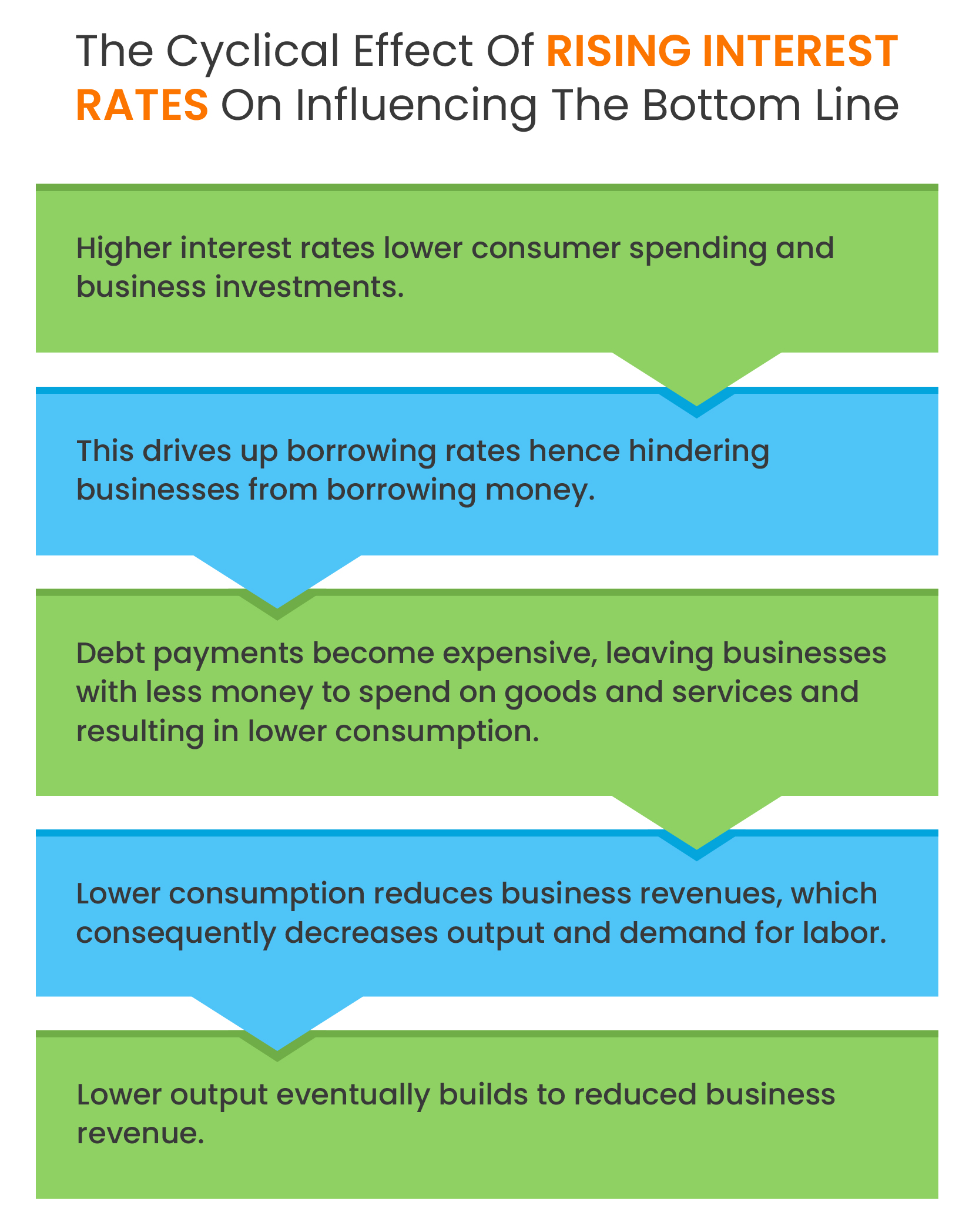

If your company is often maxed out on credit or if your company needs to borrow at the last moment, it is most prone to be hurt by rising interest rates. On the downside, treasury and finance teams usually have scarce resources. Moreover, their bandwidth gets occupied with transactional tasks instead of focusing their time on strategic tasks. With lean teams and changing macroeconomics, how do they start their journey to increase operational efficiency and boost the bottom line?Download this eBook to learn how rising interest rates can affect borrowing for your business and how treasury cashflow forecasting software can help make accurate and agile borrowing decisions.

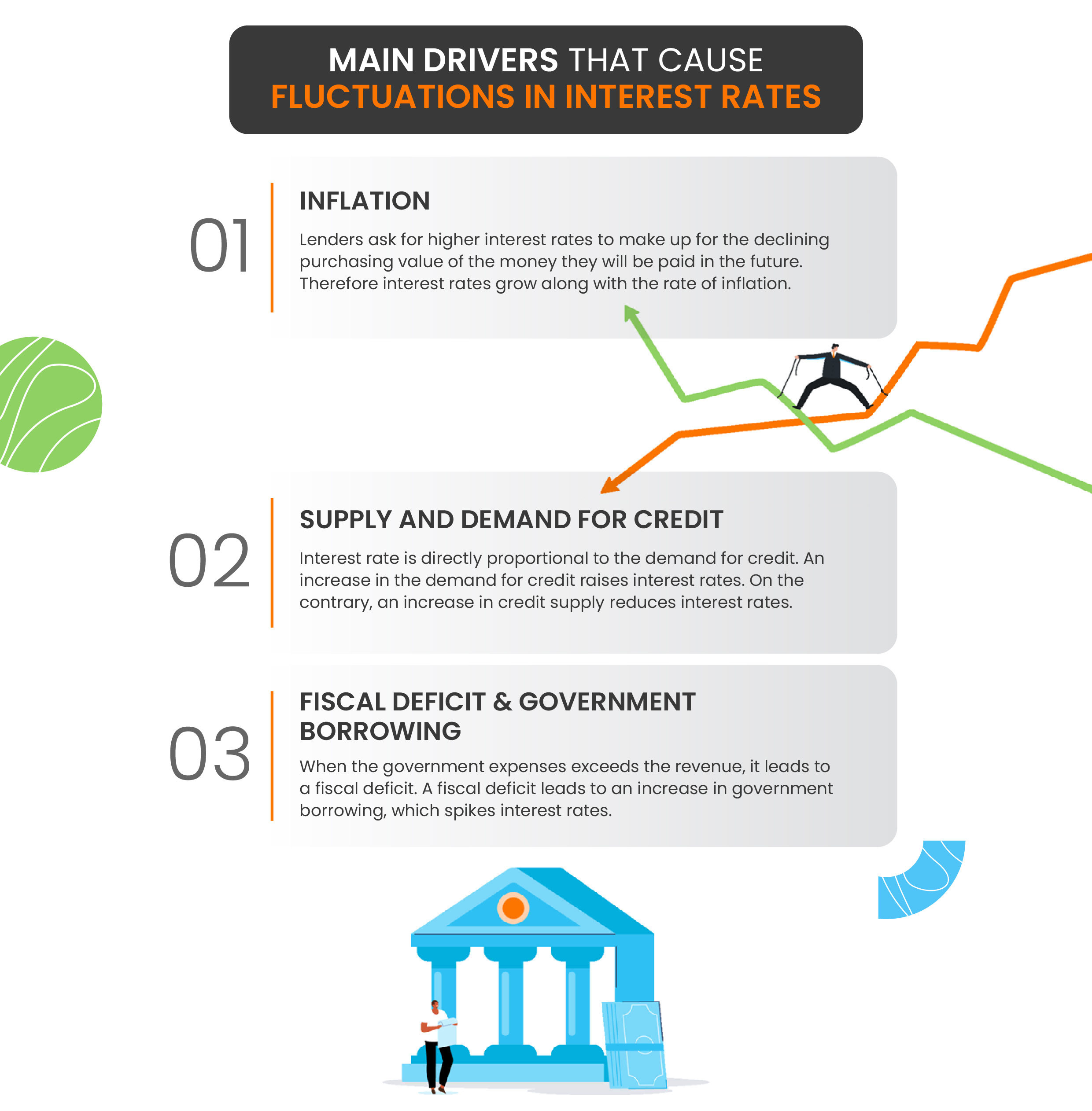

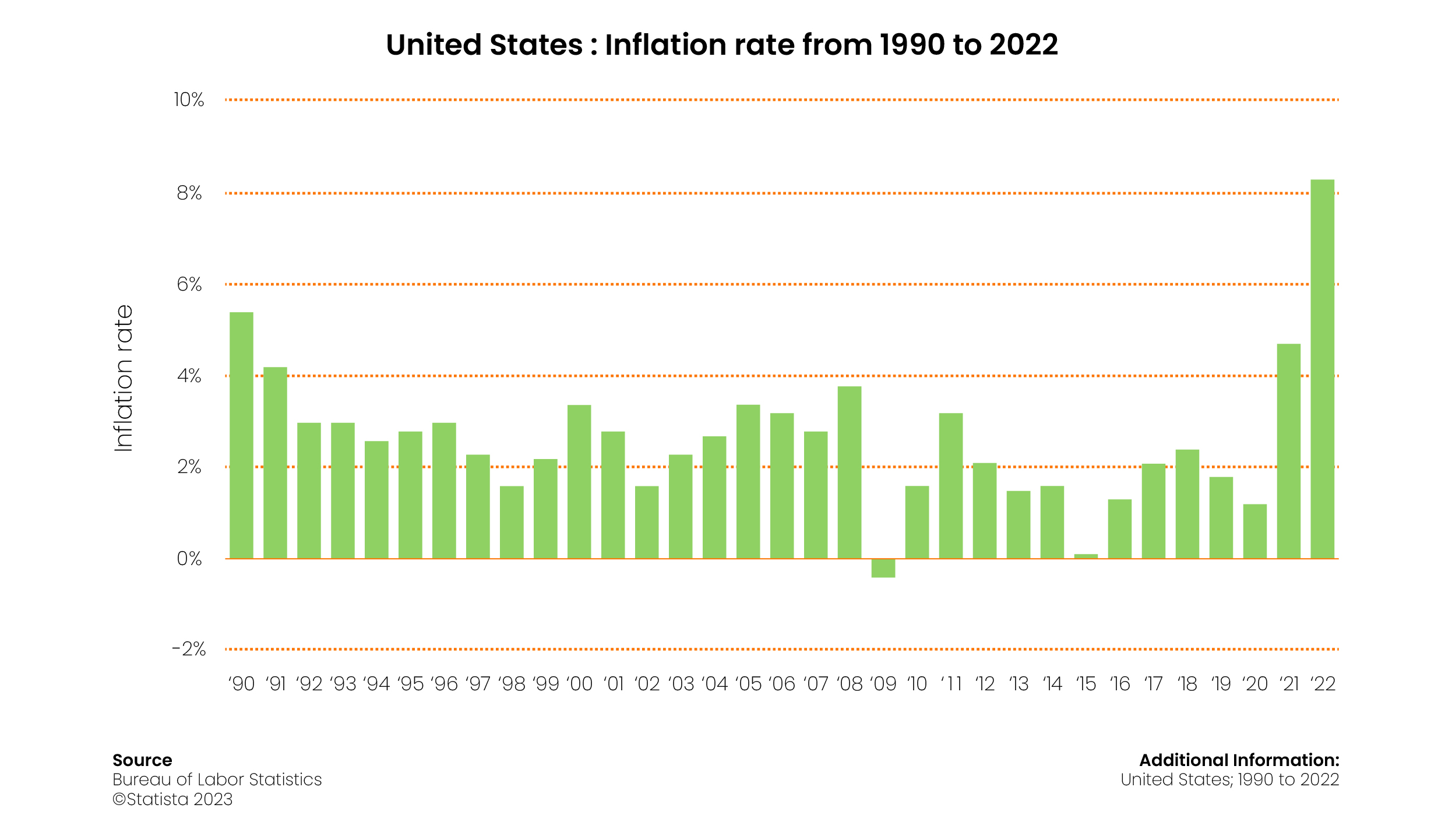

Owing to the deadly combination of inflation risk and tight labor markets, rates are bound to stay above neutral to balance to combat the effects of stubbornly high inflation. Shedding some more light on this, the Fed raised interest rates seven times in the past year to combat rising inflation. In January 2023, the federal funds rate was 4.43%. Meanwhile, it has been predicted by the FOMC that the rate could continue to grow and peak at approximately 4.9% in 2023.

Owing to the deadly combination of inflation risk and tight labor markets, rates are bound to stay above neutral to balance to combat the effects of stubbornly high inflation. Shedding some more light on this, the Fed raised interest rates seven times in the past year to combat rising inflation. In January 2023, the federal funds rate was 4.43%. Meanwhile, it has been predicted by the FOMC that the rate could continue to grow and peak at approximately 4.9% in 2023.