Chapter

01

Introduction

During the pandemic, financial departments embraced technology to enhance efficiency and agility, replacing their previous manual processes. This shift aided remote work, but they have yet to adopt advanced intelligent technology for rapid innovation and financial decision-making.

However, financial technology players have evolved from rule-based automation that automated routine tasks with structured data to developing AI that processes unstructured data and supports predictive analysis.

Chapter

02

How AI Helps R2R Teams Save Time and Cost

Today, nearly half of every finance team’s time is still spent on transactional activities. Less than 10% of activities are dedicated to analysis and action.

To deliver strategic, financial, and operational insights on organizational performance, the finance function must transform the record-to-report process. This encompasses the end-to-end activities of recording, closing, consolidating, and reporting financial data at the end of each period. By enhancing and modernizing this process, finance teams can provide valuable feedback and analysis to drive informed decision-making throughout the organization.

Chapter

03

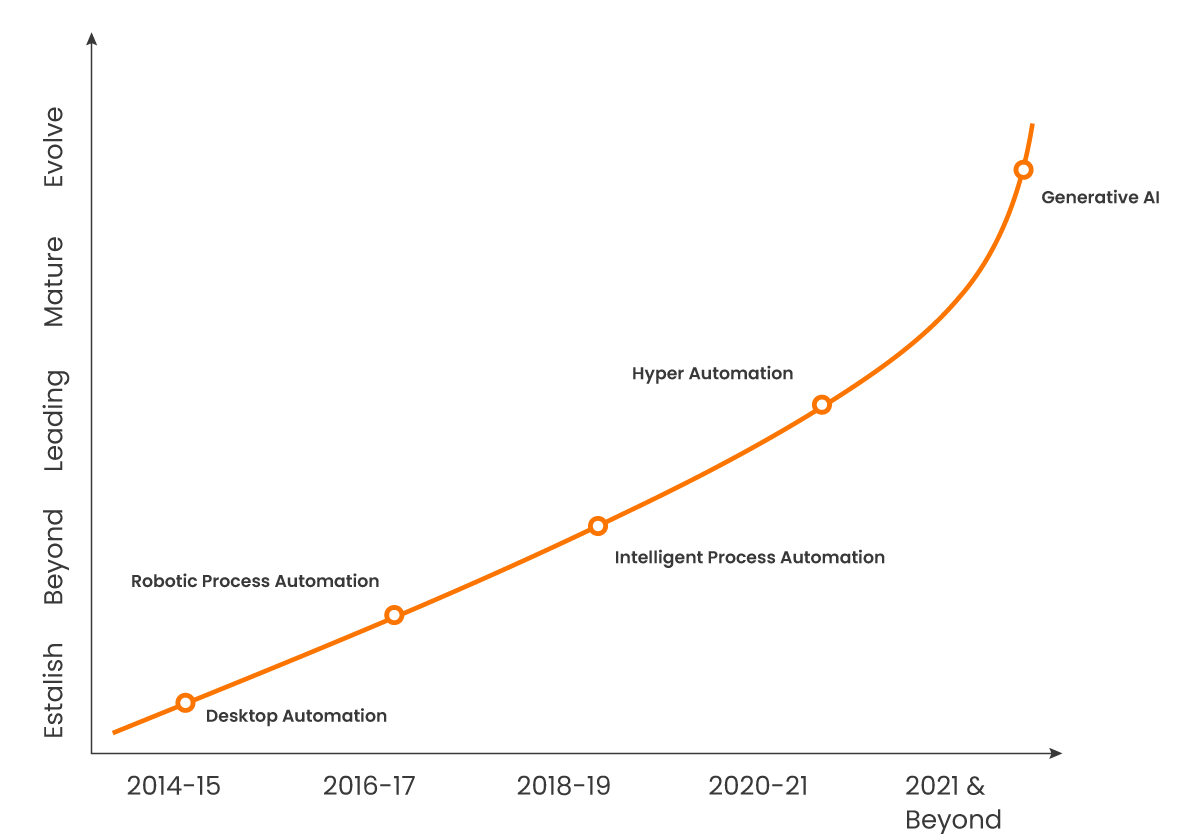

Evolution of R2R Automation Technology

- Significant developments in the Automation space in the past few years

- Generative AI has opened a whole new set of solutions

- Significant opportunity for clients to leapfrog and drive FTE reduction in offshore

Robotics Process Automation

Automate the processing of invoices, payment reconciliations, and vendor management, which will streamline the treasury procedures.

Advantages

- Scalable Virtual Workers

- Work orchestration (scheduling/queuing)

- Centralized robot management

- Manual Control & management of bots

Intelligent Process Automation

A holistic approach to transformation, IPA mostly includes solutions that include RPA, Intelligent Document Processing, and Virtual Agents.

Advantages

- Intelligent Process Automation

- Use of Artificial Intelligence technologies including Machine Learning and Natural Language Processing to enable

- Processing unstructured data

- Predictive and prescriptive analytics

Hyper Automation

Adding intelligence to existing solutions. Inclusion of AI building blocks and moving from rule-based to more decision-based solutions.

Advantages

Add AI building blocks (e.g. text analytics, machine learning) to their RPA to make IPA (Intelligent Process Automation) use cases

Generative AI

Generative AI has opened new Automation possibilities. Automation can now go wider and deeper than Shared Service & enable more effective decision-making at the highest level

Advantages

Use of Generative AI to enable execution of judgment-based and creative use cases (e.g. ChatGPT, Bart, etc).

Chapter

04

The Impact of Implementing AI in R2R Processes

Key Features of Modern Accounting Systems

Integrating AI into the record-to-report process brings efficiency and improved decision-making. AI-powered workflows can conduct qualitative reviews of journal entries, leveraging historical data and enforcing organizational policies for exceptional accuracy. Machine learning enables over 99% first-pass accuracy, streamlining operations and allowing finance teams to focus on strategic activities. In reconciliations, AI analyzes anomalies, providing insights for risk identification and better decision-making, enhancing accuracy and efficiency while gaining valuable financial performance insights.

Chapter

05

Real-Life Cases of AI Implementation in R2R

Case Study 1

Client Background

- Anglow-Swedish multinational pharmaceutical and biopharmaceutical company

- $44.48 B in revenue

- 83,500+ employees

Challenges

- A $44b pharma company wanted to reduce its close cycle time and manual work efforts Common challenges identified were:

- Complexity of multiple enterprise resource planning systems (ERPs)

- Elimination of high number of manual financial close processes

- Outdated chart of accounts and data model that fails to meet the latest reporting requirements

- Manual reconciliations

- Integrate technology to bring automation and efficiencies

- Lack of skill sets and risk-averse culture

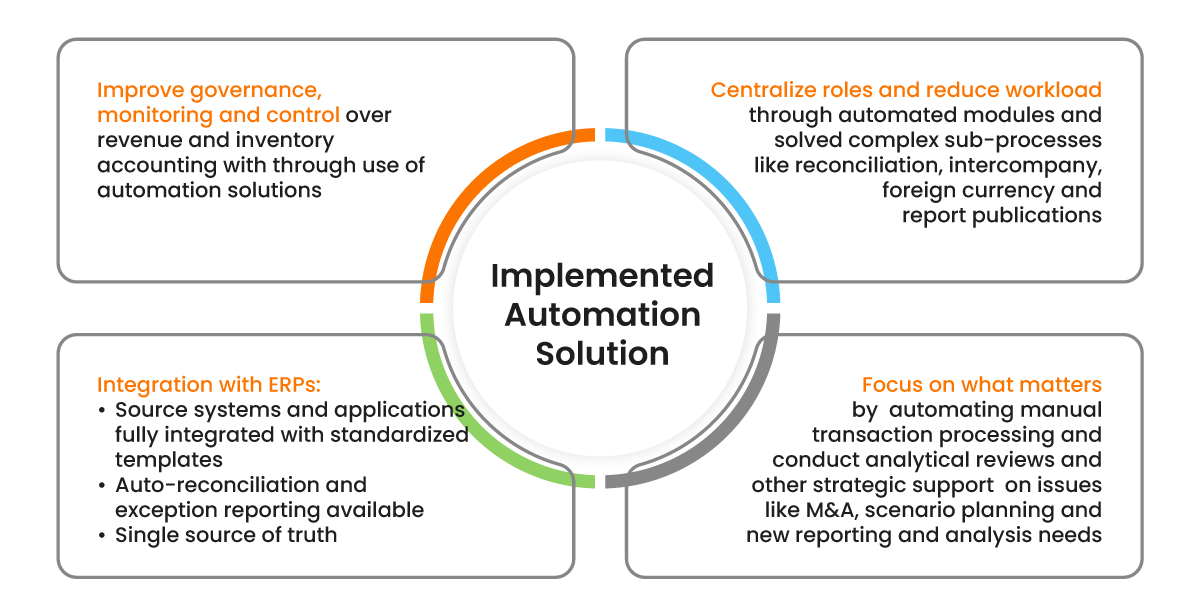

Solutions Delivered

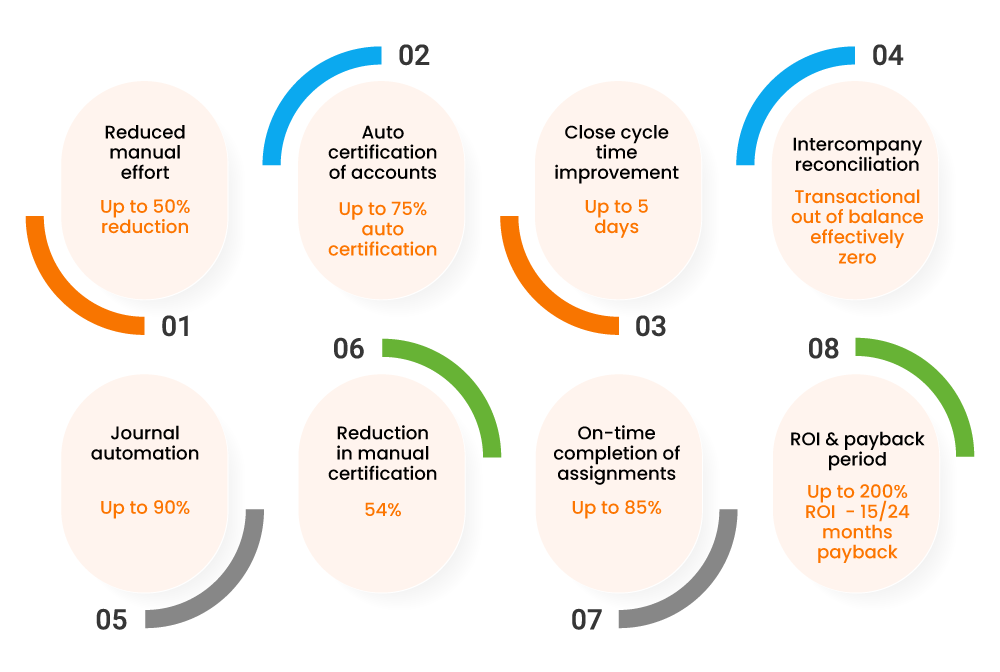

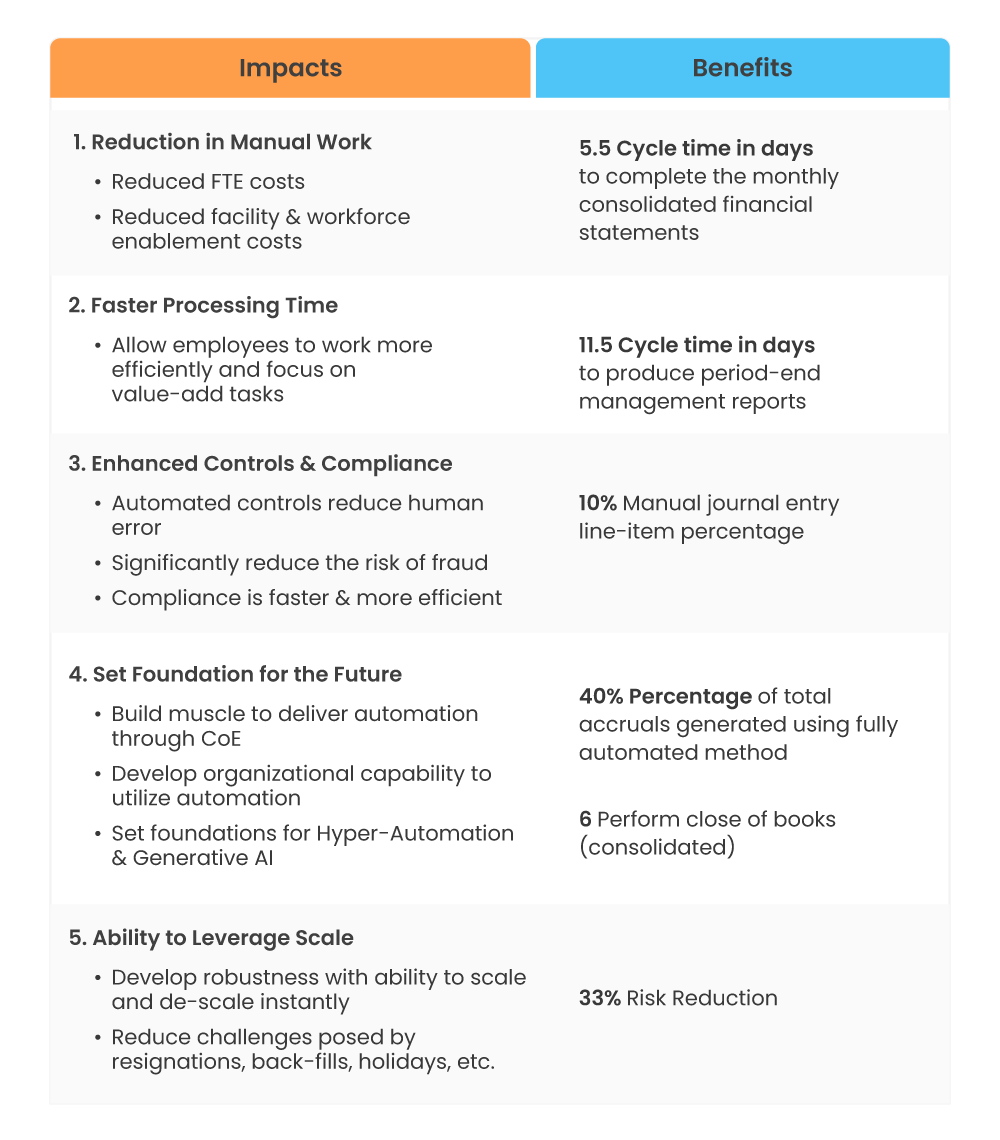

Benefits Achieved with implementation of automation solution

Case Study 2

Client Background

- British multinational consumer goods company

- USD £16B in revenue

- 61,000+ employees

- Operations in 100+ countries across globe

Challenges

The business was growing rapidly, and the finance organization not only needed to keep pace, but also needed to provide increased business partnership and analytics to support faster, better decision-making.

- Lack of standardization of global month end closing checklist as every country worked to a different timetable

- Record-to-report (R2R) process was highly manual (~97% manual activities) with under-optimized use of technology and automation

- Clear issues around controls, data quality, and non-standard processes

- Lack of a formal journal entry approval process and workflow with journals being approved over e-mails

- Significant number of journals posted with immaterial amounts during month end closing, accounting for majority of time spent on non value adding activities

Benefits Achieved with implementation of automation solution

Chapter

06

How HighRadius is Helping Companies Improve Their R2R Processes

HighRadius revolutionizes accounting processes with advanced technology, offering end-to-end solutions that automate and streamline Record to Report (R2R) workflows. With AI-powered features HighRadius empowers organizations to transform their accounting approach, enhancing efficiency and accuracy.

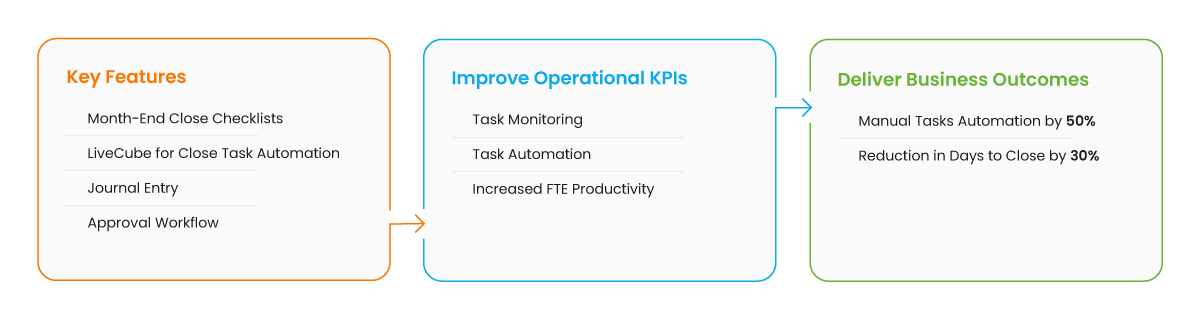

Financial Close

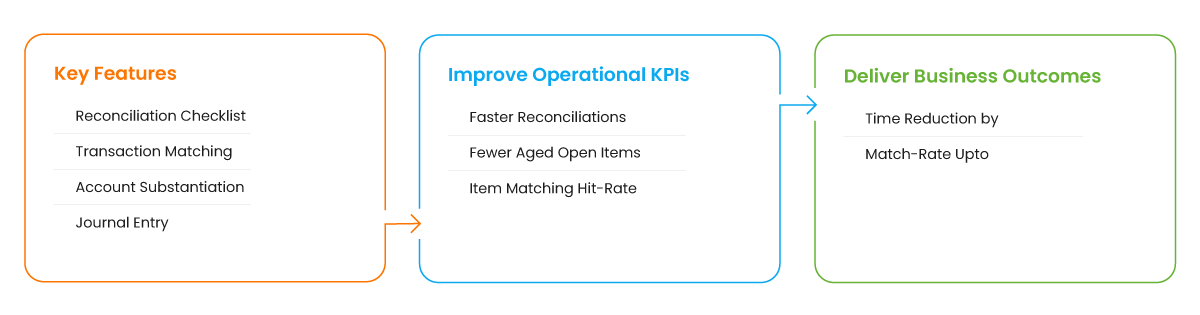

Account Reconciliation

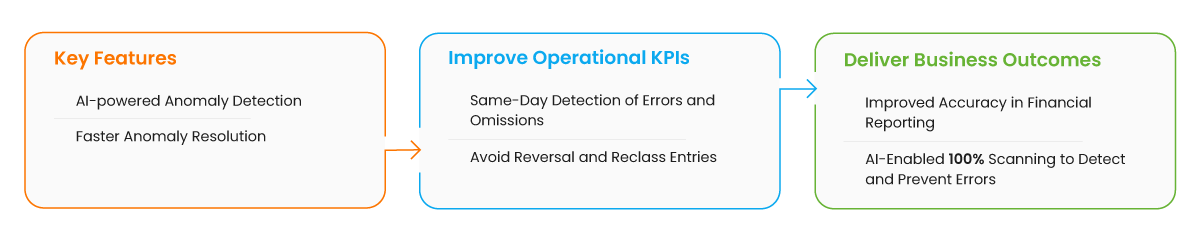

Anomaly Management