Collections management is like a ship’s navigation system. It helps businesses map out their financial course and steer clear of rocky shoals. Key components of collections management include prioritizing collections worklists, scaling dunning outreach, and processing payments efficiently. Think of these as the compass, the map, and the rudder of your financial ship.

Charting a cash recovery course with the right compass

A prioritized worklist guides analysts to high-value accounts in the vast sea of accounts receivable.

So, how does it work?

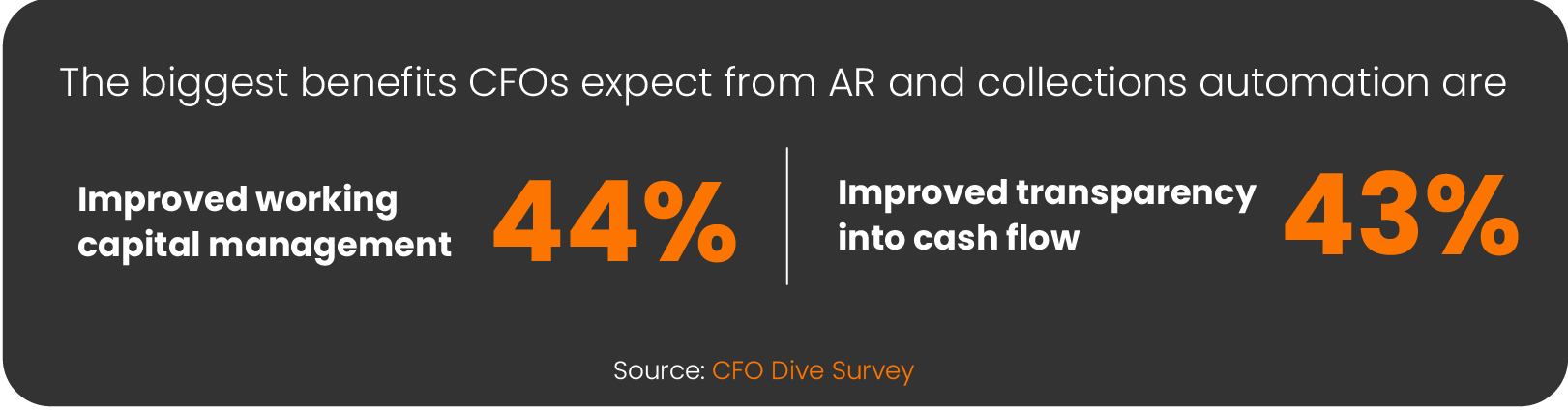

An Auto-Prioritized Worklist provides a clear and organized view of accounts that need attention based on data such as account balance, payment history, and credit risk. This helps the collections team to easily track, prioritize and collect from accounts that are most likely to yield a positive outcome.

Since an auto-prioritized worklist provides real-time visibility into account details, the collections team can also streamline their workflow, improve communication, and make adjustments for a faster recovery of past-due receivables, resulting in a higher profit for the company.

Unfolding the map to hidden riches of past-due accounts

Automated dunning outreach assists collections teams to map a swift course to customer connections and cash recovery.

So how does an automated dunning outreach work?

Automated dunning outreach allows businesses to automate sending different dunning emails for different types of customers, reminding them of overdue payments and guiding them towards making payments on time. This eliminates the need for manual outreach and helps the team to focus on more complex accounts.

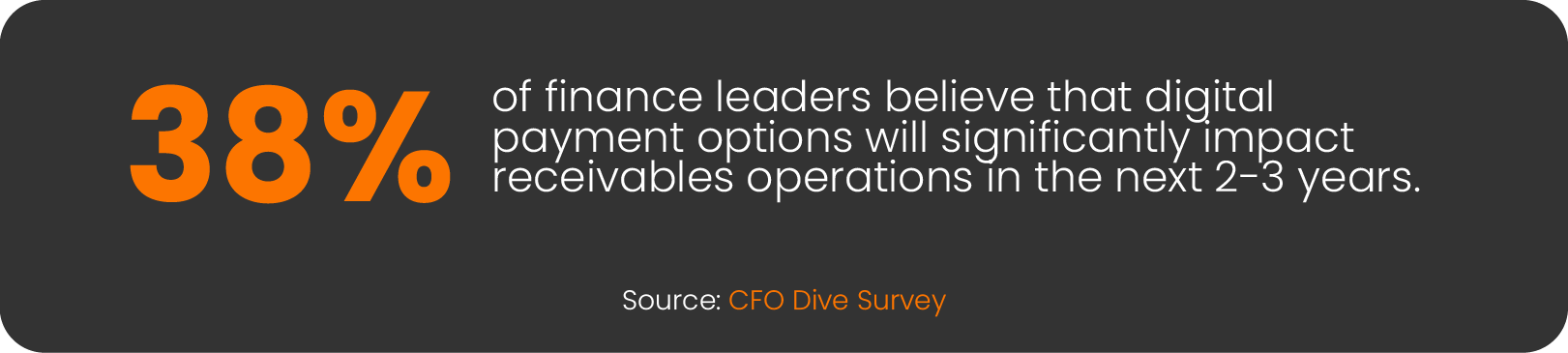

Moreover, automated dunning also provides real-time data and analytics on customer behavior and payment patterns, which can be used to identify trends and make adjustments to the collections strategy. For example, businesses can use this data to identify which customers are most likely to pay and target them with more aggressive outreach, thus increasing the chances of getting paid faster.

Steering the rudder to the treasure trove of timely payments

Frictionless payment processing steers the business’ financial journey toward profit and growth.

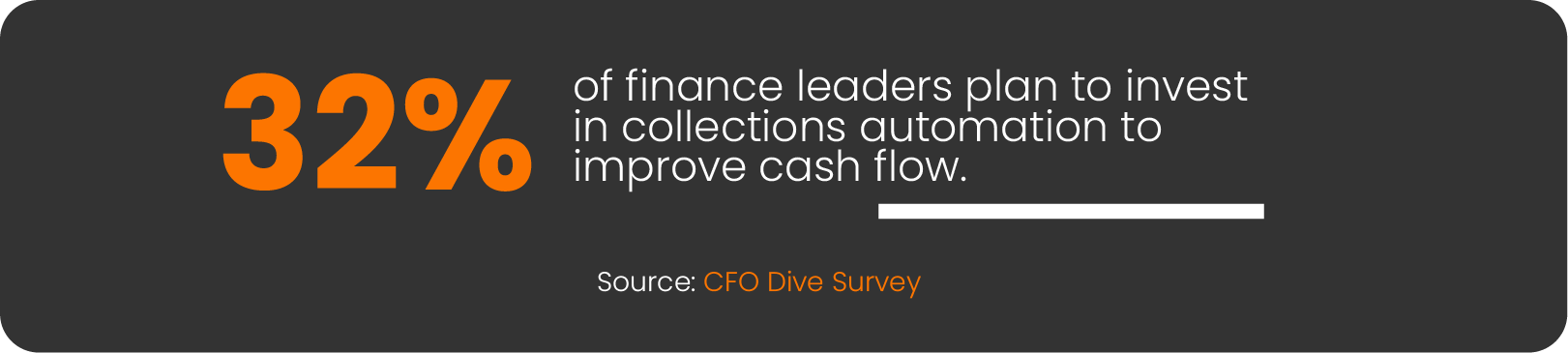

While there are many ways to improve cash flow, one of the most effective is to make it as easy as possible for customers to pay their bills. This is where frictionless payment processing comes in. Businesses can achieve this through techniques such as leveraging guest payment pages, introducing electronic payment options, embedding links in their preferred payment formats, and even using AI-powered chatbots to help customers troubleshoot issues.

Moreover, by making payment processing frictionless, businesses can reduce customer churn, and improve the overall recovery rate. And because frictionless payment processing can be integrated with other strategies such as automated dunning outreach and auto-prioritized worklist, businesses can also improve their overall

collections performance.