Organizing the Month End Financial Close Process

What's Inside?

- Key challenges of disconnected tools in the financial close process

- How to convert the chaotic close process into the desired “choreographed close"

For many companies, the monthly close process is like “herding cats”. Lots of different tasks with different dependencies, different risks, different levels of expertise required to validate and different approval authorizations for journal entries. To make matters worse, the monthly financial close is an “all [accounting] hands on deck” process with lots of transactions from different sources requiring different techniques and processes for validation, reconciliation and analysis.

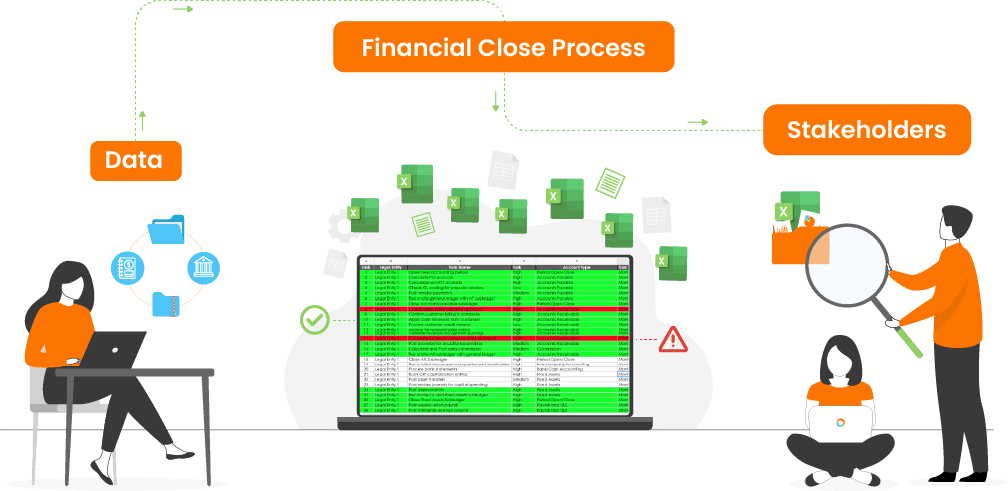

There are different people, in different departments who have different knowledge about the validity of transactions. There is the need to balance accuracy with available resources and time to close. Balancing 100% accuracy requirements, with resource and time constraints is always a challenge. In addition to these processing complexities, the monthly close process is performed with a set of disconnected tools.

Task Management: The close task management is typically controlled by a task checklist in a spreadsheet, which lacks collaboration functionality and real-time updates. Many times the checklist is as simple as a task ID, and task description and provides little utility beyond a simple checklist. While the checklist provides a guide of what needs to be done, it fails as a status report of the financial close process because it must be manually updated and is never up to date. When it is not updated on a timely basis it leads to duplication of effort and the opportunity for dependent tasks to be performed out of sequence.

The row in the spreadsheet is green if completed, red if in trouble, yellow if started and no color if not started. [Hint: nothing is ever yellow because nobody updates the status while that task is being processed.]

Task execution: It is typically performed in a spreadsheet, disconnected from the data and the task checklist. It represents the how, when and by whom the process is being performed. The techniques used determine the complexity of the spreadsheet. For example, The reconciliation spreadsheet has different tabs for GL account balance and transactions, bank balance and bank transactions, and the final one for matching the transactions. The last tab rows will be annotated with green, yellow, & red colors as per the transactions match status. During the financial close process one would make multiple runs at the third tab with different sets of vlookup logic to match more transactions, all working within the time constraints of the close deadline. While the spreadsheet provides better automation than 12-column accounting paper, it is still a very manual, error-prone process. The results of a reconciliation or account analysis may end with an adjusting journal entry, but in many cases, that is disconnected from the spreadsheet or totals are “hacked” by grabbing rows that don’t match, via copy and pasting them to a journal entry tab, to be “fat-fingered” into the general ledger.

Journal Entry Posting: Even if the spreadsheet can be used to calculate the journal entry, it still must be entered into the general ledger. It is interesting to note that even after all types of tasks are performed to analyze an account or an account reconciliation, nothing matters if the journal entry doesn’t get posted to the General Ledger on time.

The above-mentioned factors contribute to the “chaotic close” rather than the desired “choreographed close”.

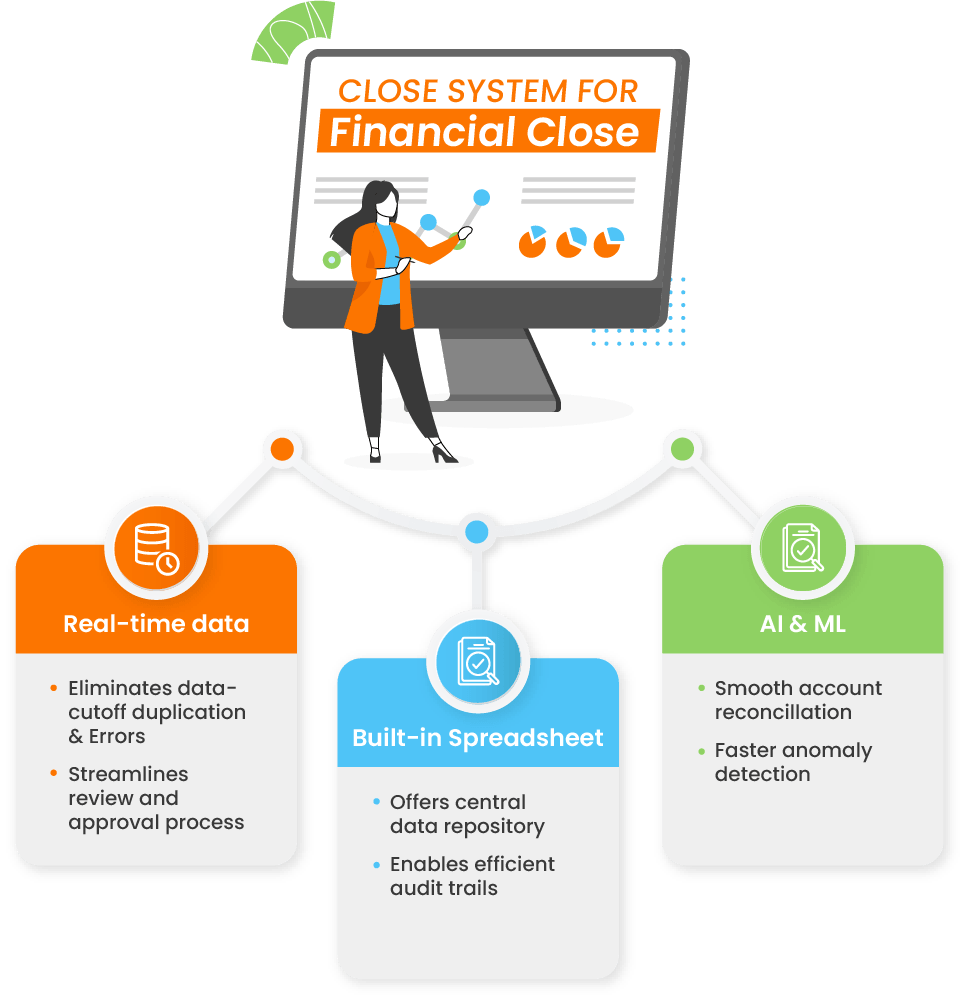

The monthly financial close process needs a “closed” system, just like Accounts Payable and Accounts Receivable each have their own “closed” system. A “closed” system is where all activities related to a specific group of tasks are performed within the system.

For the Financial Close process, a “closed” system would include:

Financial Close is not like a relatively linear system like Accounts Payable or Accounts Receivable. It not only has to be flexible to accommodate all different types of reviews, but also be connected. For example, spreadsheets/accounting workpapers need to be connected to the workflow tasks. The spreadsheets need to be connected to a database and under “systems” control. They also need to be connected to the real time data and the spreadsheets/close system need to be connected to the adjusting journal posted to the General Ledger.

The first and the most important step is to implement a financial close automation system. This system needs to connect monthly close tasks and workflow with the workpapers/spreadsheets, and the resulting adjusting journal entries in a close system.

As mentioned above, the financial close automation system enables the finance team to achieve an orchestrated close process by shortening the close cycle, improving the accuracy and creating the close binder for the auditors.

Learn how to make day-zero financial close automation a reality through immediate and accurate decisions.

The next ebook will also review connected workspaces and how to “close” the system between tasks, spreadsheets and close workpapers. This will also ensure an updated, and current close status report, and connecting to the General Ledger it will enable adjusting journal entries posted back to the General Ledger.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Talk to our experts