Chapter

01

What is a cash flow management system?

A cash flow management system is used to track, reconcile, and report a company’s cash flows. The system is especially useful for handling cash flows across several corporate branches, including foreign ones and businesses with complex bank account arrangements. Cash management software can also open, register, change, and close bank accounts. Account signatories can also be added, updated, and authorized.

What is the primary goal of cash flow management system software?

Cash flow management system software is essential for a company’s financial stability to be established and maintained. The primary goal of cash flow management is to guarantee that the input of funds always meets the outflow.

According to a survey sponsored by SAP Universal ID, 80 percent of finance professionals say that cash management, reporting, and forecasting have become more important as modern firms’ complexity and volatility have increased.

Chapter

02

Challenges faced without cash management software

Here are the main challenges faced without cash management software:

Chapter

03

What are the objectives of cash management?

Cash management’s main purpose is maintaining a balance between liquidity and profitability to maximize long-term profit. This is only achievable if the company strives to maximize the utilization of funds in the working capital pool.

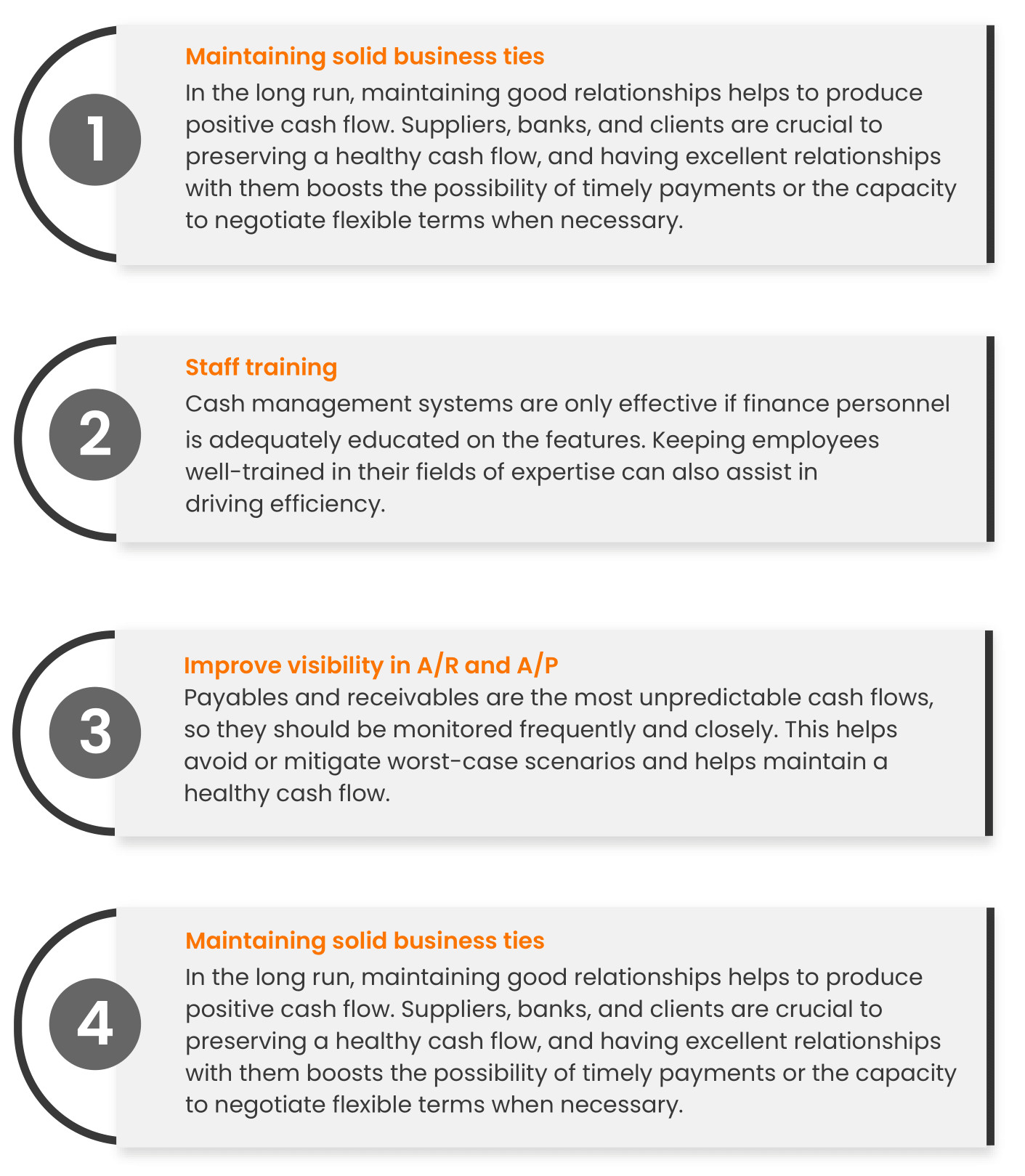

5 Ways to improve cash flow management

Chapter

04

What are the advantages of using cash flow management tools to help treasurers plan for the future confidently?

The following are some of the benefits of using cash flow management tools:

- Automates time-consuming tasks with APIs and sFTP

It integrates with banks, ERPs, and third-party market data providers. Moreover, it stores files in any format and categorizes transactions based on banks, accounts, regions, and categories. This eventually helps to increase cash flow visibility.

- Automates bank reconciliation

It provides automatic bank reconciliation and user-defined tolerances, matching criteria, and auto-cash transaction creation to reconcile bank statement items automatically. The manual matching option makes it simple to identify and address exceptions.

- Accurate cash positioning

Cash management software extracts data automatically from banks and other sources and auto-populates market data, bank transactions, and other data needed to support multi-currency cash positioning.

- Bank account signatory tracking

The software helps track and manage accounts and other types of signatories. It also provides these benefits:

- Manual entry or bulk import

- Bulk edit and delete ability to update many signatories at once

- Track approval limits, different signatory groups, and types

- (Optional) Tracking of personal information (GDPR compliance)

- Improved decision making

With accurate cash flow data and positioning, decisions about borrowing, investments, acquisitions, or other critical issues are data-driven and timely. This also gives an edge by being prepared for all scenarios in advance.