The Role of Real-Time Payments in Modern Treasury Payment Management Systems

What's Inside?

- Discover how real-time payments enhance cash flow visibility and liquidity management.

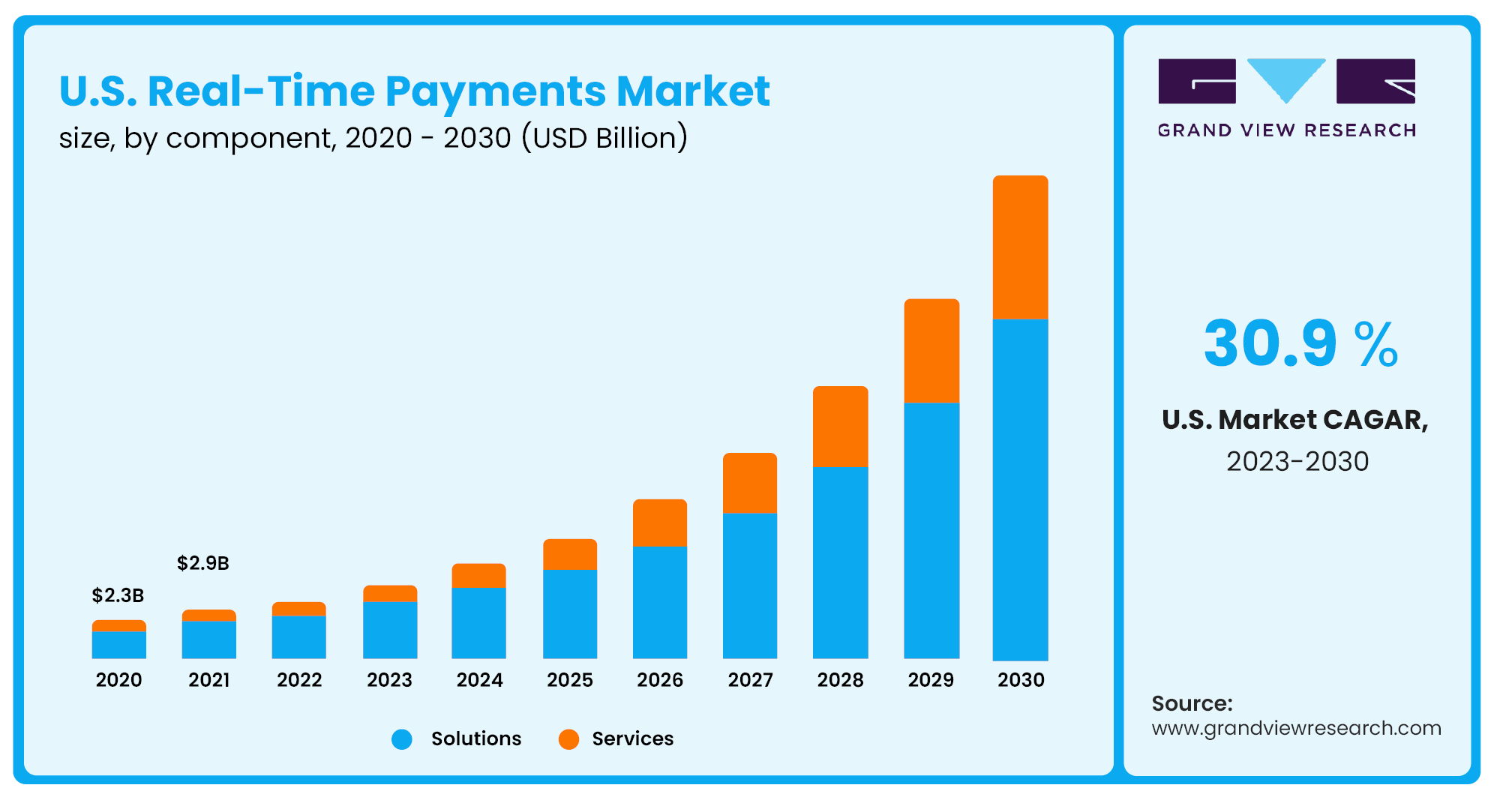

- Learn the global trends driving adoption of real-time payment systems.

- Explore how real-time payments reduce risks in cross-border and domestic transactions.

- Understand the key challenges in transitioning to real-time payments—and how to overcome them.

- See the role of AI and blockchain in transforming real-time treasury payment solutions.