Chapter

01

Problems with cash flow management that affect mid-sized businesses

Cash management is the active management of a company’s finances to:

- Maintain ongoing operations

- Mobilize funds as needed

- Maximize liquidity

Cash flow management entails making the best use of current assets and liabilities. It uses systematic planning, monitoring, as well as collection and management of information required, to make the best use of available funds.

Why is poor cash management detrimental to the financial health of a mid-sized business?

Mid-sized businesses rely more closely on their predicted monthly income to ensure their financial commitments are met. Whereas a larger business may have funds available as a last resort between late payments.

Long-term negative cash flow can put plans on hold for businesses looking to expand, as business owners are left scrambling to stay afloat rather than investing time and energy into growing. In the bigger picture, cash flow management is a useful indicator of the health of a business, and is, in fact, one of the most important financial and accounting metrics.

Chapter

02

Pointers to manage cash flow for a mid-sized business

Some businesses have a strained cash flow because of spending most of their incoming funds. They may spend the majority of their money on paying invoices or may have a large sum of money owed to them at some future point in time.

Positive cash flow allows businesses to respond to opportunities. A company with positive cash flow is better able to react to opportunities and challenges. They are better equipped to deal with an emergency quickly and can also put money into their company and pay off debts.

Signs to monitor your cash flows more frequently

It’s easy to miss early warning signs of potential cash flow problems if businesses don’t monitor their cash inflows and outflows on a daily basis. The tell-tale signs to increase the frequency of cash flow monitoring are as follows:

- Late or missed payments- If unpaid invoices begin to pile up, the company may be experiencing a cash flow problem. Even with automatic reminders, it’s difficult to afford to pay business bills if the funds aren’t readily available. Late or missed payments, whether due to poor administration or a lack of cash, can result in a low business credit score, limiting the ability to secure finance, find suppliers, and form partnerships.

- Negative cash flow- While many business owners monitor cash flow, a sudden financial crisis can quickly turn into a problem. When this occurs, it is extremely difficult to increase revenue quickly enough to cover the costs. As a result, it’s critical to take as many precautions to ensure readiness for such situations.

- Struggling to meet financial obligations- Managing costs is simpler if one has a positive cash flow. If it’s a monthly struggle to meet financial obligations, it’s time to increase the frequency of cash flow management. Cash flow management helps businesses know exactly what’s coming in and when it’s coming in, allowing them to set up payment terms for their outflows so that they aren’t missed.

Chapter

03

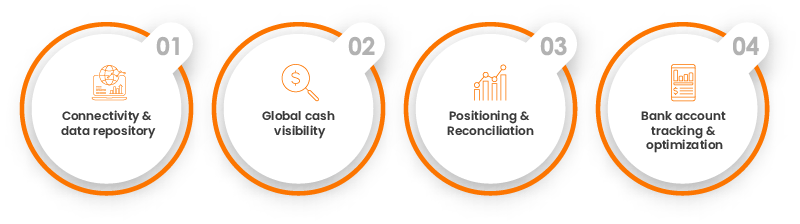

The four pillars of cash flow management

The four principles on which cash management is based are:

- Connectivity & data repository: Keeping track and storing bank transactions and information is a crucial step in managing problems of cash flow management. To obtain real-time data, using integrated platforms with real-time connectivity to banks helps. Big data platforms, SaaS, and cloud-based platforms enable businesses to store indefinite amounts of data, along with providing the connectivity treasurers require to ensure smooth functioning from anywhere in the world.

- Global cash visibility: Global cash visibility and reporting is required for treasury to meet strategic needs. With system suggestions and recommendations, global visibility gives mid-sized businesses an optimized view of all bank accounts across multiple entities.

- Positioning & Reconciliation: Determining the cash surplus and deficit, making investment and borrowing decisions, and reconciling exceptions help manage cash flows efficiently. It is helpful to use AI-based algorithms for reconciling a company’s cash and APIs to obtain real-time cash positions.

- Bank account tracking & optimization: Keeping a track of all bank account-related information, including signatories, and enhancing the number and framework of bank accounts is an important part of cash management, as it helps gain a complete understanding of a company’s cash position. Utilizing automated workflow-driven methods to maintain, open, and close bank accounts, and audit these processes on an annual basis using the most recent bank structure and features makes optimization and tracking of bank accounts easier.

Chapter

04

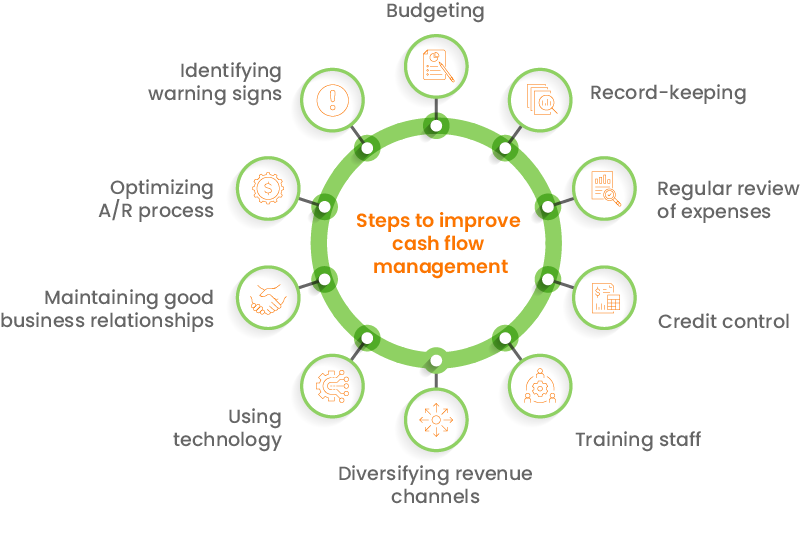

Steps to strengthen cash flow management in mid-sized businesses

The following are ten simple tips that mid-sized businesses can follow to reduce cash the problems of cash flow management:

- Budgeting: Setting a budget is a founding step for any problems of cash flow management that a business faces. Before making any major financial decisions, it is a best practice to carefully record the company’s expected earnings and outgoings. This allows treasurers to easily measure if the cash flow is expected to be positive or negative and adjust financial plans accordingly.

- Record-keeping: It is critical to develop an efficient reporting system for a company’s records in order to support compliance and credit score. Tracking a company’s performance against its historical performance and that of its competitors in the industry helps gain a better understanding of the statement of financial position. The kinds of documents and data that companies should keep track of and review regularly are:

- Income

- Uncollected funds

- Funds owed

- Recurring costs

- Cash on hand

- Inventory

- Independent revenue streams: Lucrative and non-lucrative ones

- Profit after taxes

- Regular review of expenses: Business expenses can quickly add up, especially as a business expands and hires more employees. Organizations need to maintain financial control by conducting regular audits to determine how much is spent and how much income is needed to cover the costs. Some key areas to concentrate on are:

- Bills for energy

- Printing and paper

- Travel

- Technical systems and apparatus

- Credit control: A strong credit control system is essential for maintaining a healthy cash flow, accelerating the receipt of any money owed, and reducing the risk of late payments. A good credit control process revolves around several factors, such as:

- Clients

- Clear payment terms

- Training staff: Credit control systems are only effective if finance personnel are fully trained on the significance of payments. Keeping staff well-skilled in their area of expertise can also help to drive efficiency and lower overall costs for the business.

- Diversifying revenue channels: Operating with a diverse product line can assist companies in increasing revenue streams and lowering financial risk. Businesses with only one revenue stream are vulnerable to failure if their chosen industry or offering encounters financial difficulties.

- Using technology: If an organization’s cash management software requires frequent manual intervention to consolidate data, it results in low cash visibility. This impedes its ability to make data-driven proactive decisions. With cash management automation, a company can eliminate manual workflow processes and focus on strategic initiatives that add value to the company.

- Maintaining good business relationships: Maintaining good relationships help build positive cash flow in the long run. Suppliers, banks, and clients are critical to maintaining a healthy cash flow, and keeping on good terms with them increases the likelihood of timely payments or the ability to negotiate flexible terms when necessary.

- Optimizing A/R process: If credit is extended to customers, it is critical to ensure that the accounts receivable process of the business is optimized. Accounts receivable optimization is an excellent way to ensure cash flow is managed correctly and efficiently.

- Identifying the warning signs: An organization must be able to recognize early warning signs. Acting quickly can reduce the likelihood of any repercussions, such as a lower credit score for a business or reputational damage if they are unable to meet their payments.

Chapter

05

How to ensure a smooth cash flow management process?

While implementing some or all of the ten steps outlined above can help companies in increasing their cash flow, it is also important to review and update the cash position regularly to ensure that treasurers can anticipate trends and challenges before they have an impact on the company’s profitability. Businesses should implement cash management automation to help adjust to the growing need for strengthening cash management in the face of market fluctuation.

The HighRadius cash management software helps mid-market treasury in the following ways:

- Complete global cash visibility- Single dashboard view of your cash across all banks, regions, companies, and currencies improves cash utilization.

- Enhanced efficiency- Automated cash positioning allows you to proactively identify and plan for daily and weekly cash requirements.

- Improved decision making- Automated global cash visibility provides users with the information and time essential to make the right investment and funding decisions.

- Increased profitability- Informed and faster decision-making helps minimize interest expense or maximize interest income depending on your overall global cash position.