2023: A Look At The Macroeconomic Conditions

2023 is a trickier turf compared to its predecessor 2022, and winning on it will require a totally different game plan.

In 2022, 65% of CFOs we surveyed were confident of achieving 20%+ revenue growth. But only 8% expect to achieve similar revenue gains in 2023.

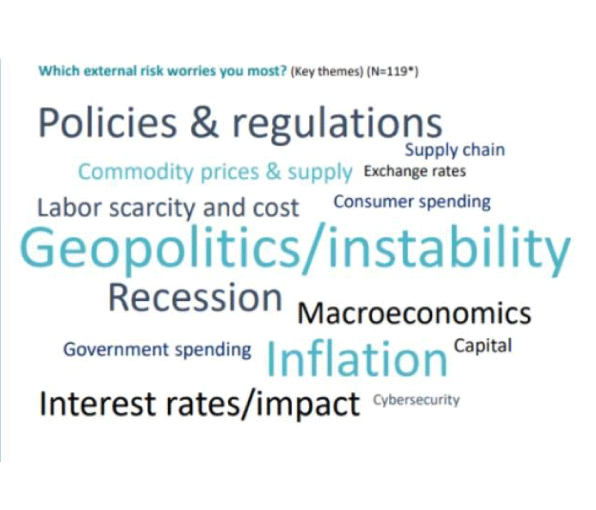

A recession, persistent inflation, higher cost of capital, geopolitical risks, currency fluctuations, and lingering risks of COVID-19 will shape the 2023 business environment. The war for quality talent, increased cyberattacks, and lower funding are other trends that’ll dominate 2023.

Chief financial officers play a key role in steering their business in such tough times. In fact, 68% of CFOs believe it is their responsibility (more than the CEOs) to steer their business through a recession.

In this playbook, we try to envision what each quarter of 2023 will be like as well as discuss actions that CFOs can take during these periods.

| Macro conditions during each leg of the race |

CFO focus areas |

| Q1 2023

High inflation and high-interest rates, COVID-19 uncertainties, lay-offs |

Budgeting, tech & financial planning, team restructuring, hiring plans, cash forecasting, annual report presentations & investor relations management |

| Q2 2023

Recession, continued inflation and high-interest rates, bad debt rise |

Cost optimization, receivables management, payment collections |

| Q3 2023

Improved business confidence and optimism, green shoots of recovery |

Re-evaluate digital transformation projects, identify M&A opportunities, hiring reassessments, competitor evaluation |

| Q4 2023

More positive economic environment, interest rate cuts, cooling cost pressures |

Review financial progress, auditing and filing compliance docs, set fresh goals, forecasting, and budgeting for the coming year |