Balance Sheet Reconciliation Software

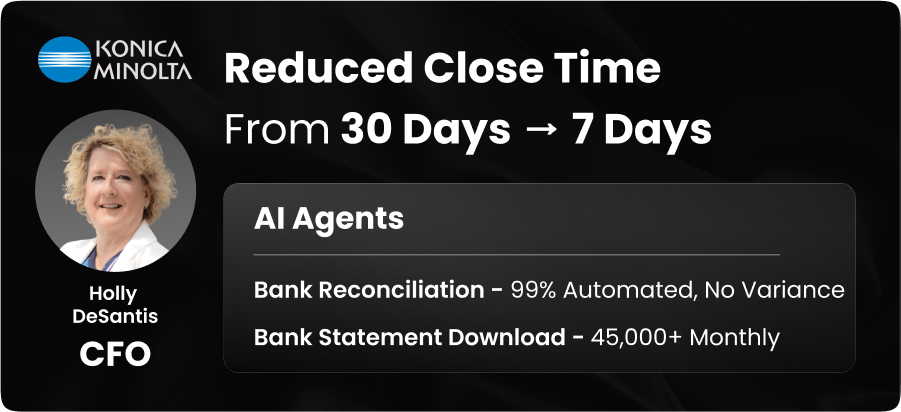

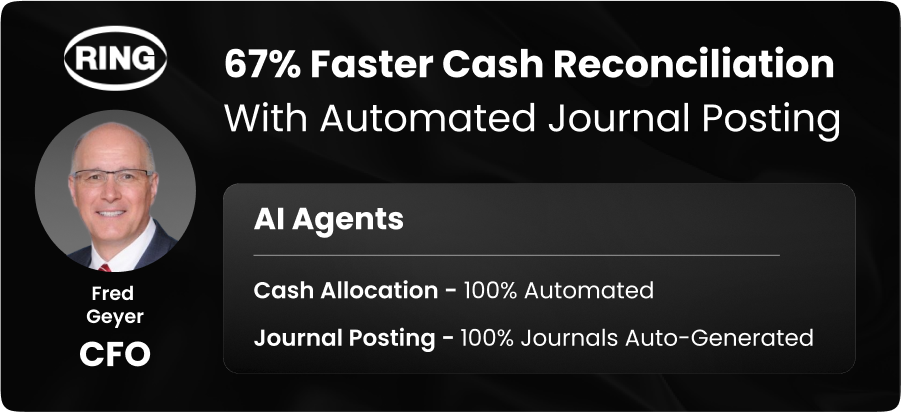

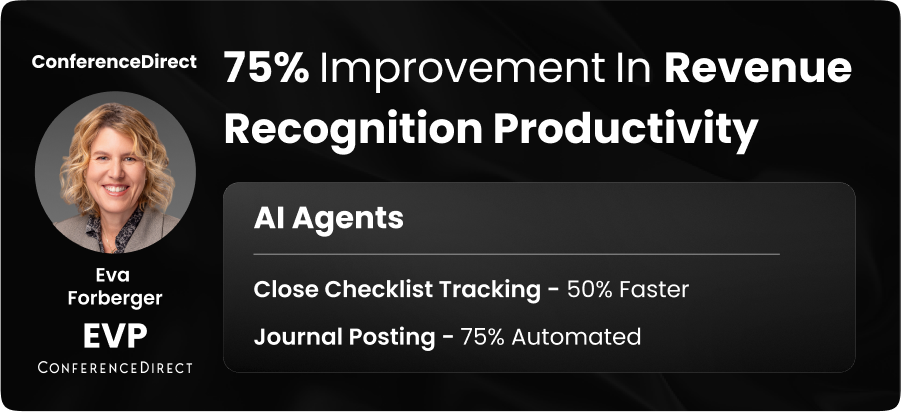

AI agents automate balance sheet reconciliations, flag exceptions, classify variances, and post journals—ensuring compliance and real-time visibility.

Automate reconciliations by 90%

Achieve 95% journal posting automation