Cash Management Software

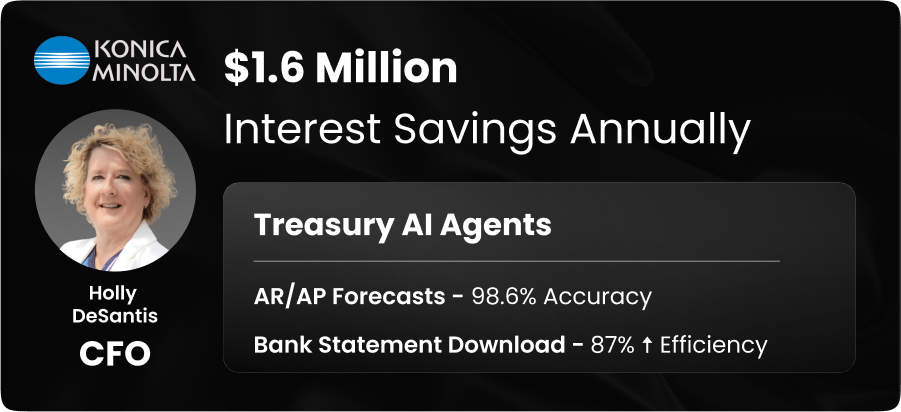

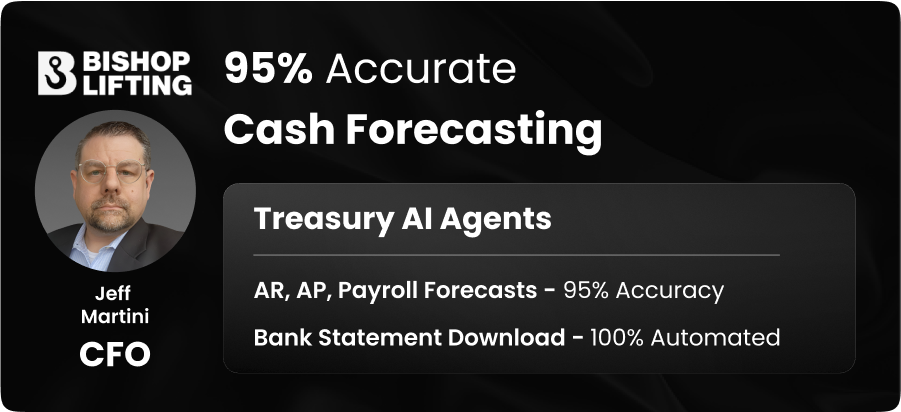

AI agents streamline cash management across all accounts, automating daily positioning, cash reconciliation, and tracking financial instruments.

Increase productivity by 70%

Enhance cash visibility to 100%