UnitedHealth Group 19-Day DSO: AI Claims and RCM Power!

How did the UnitedHealth Group maintain steady financials amid an $872 million cyberattack? Discover the secrets behind their cash flow wizardry and advanced billing techniques.

19

days DSO in 2023

$872

million cyberattack

79

days average DPO

$3

billion share repurchase

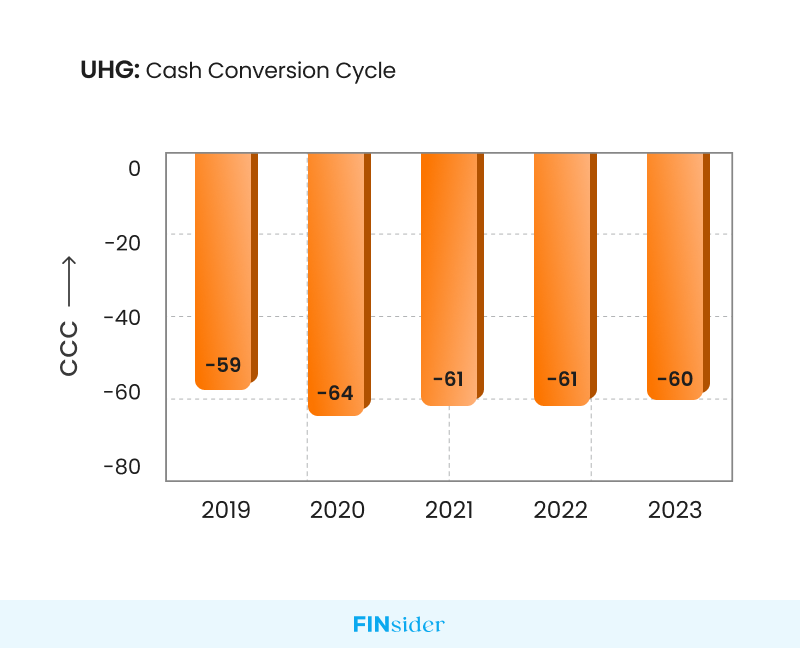

UnitedHealth Group Inc. caught my eye in a year of cyber chaos and industry upheaval. Their financial performance was astonishing. As a finance enthusiast, I unearthed a jaw-dropping secret: UnitedHealth Group boasts a negative cash conversion cycle!

With a DSO of just 19 days in 2023, UnitedHealth Group has perfected cash flow optimization. They are effectively financed by their suppliers!

Despite a staggering $872 million cyberattack on its Change Healthcare unit, the healthcare titan’s resilience remained unmatched. This was highlighted by a record $3 billion share repurchase.

Join me as I reveal the inner workings of UnitedHealth Group’s cash flow wizardry. Discover the secrets behind their stellar accounts receivables management, agile supply chain, and financial acrobatics, making them a market marvel.

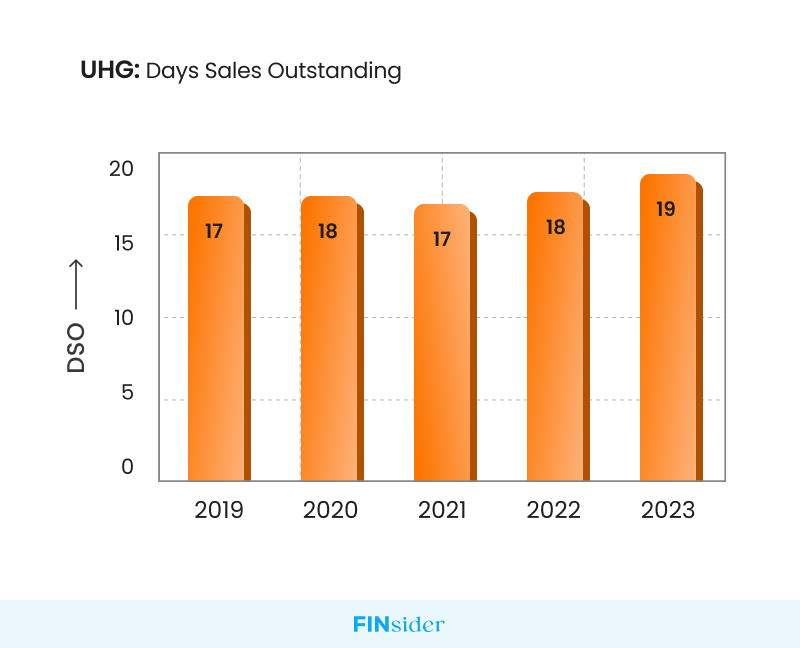

It all starts with UHG's average DSO of 18 days!

UnitedHealth Group is a cash flow wizard. Over the past five years, UHG has turned sales into cash at lightning speed.

In 2023, their Days Sales Outstanding (DSO) was just 19 days!

Over the past five years, UHG has consistently turned sales into cash with an average DSO of 18 days. Compare that to the industry average of 47 days—nearly three times longer!

This striking difference highlights UHG’s operational brilliance and ability to maintain liquidity, seamlessly fueling ongoing operations. UHG’s performance sets a new standard in financial management.

How is UHG able to consistently maintain such low DSO levels?

Advanced Billing and Payment Systems: UHG’s investment in automated claims processing and electronic health records (EHR) integration reduces billing errors and accelerates payment cycles. This ensures swift claim processing and quicker payment receipt, thereby lowering DSO.

Strong Relationships with Payers: UHG’s strong relationships with a network of payers, including insurance companies and government programs like Medicare and Medicaid, facilitate faster claims approval and payment processes. Efficient communication with payers expedites the claims process, reducing the outstanding receivables period.

Effective Revenue Cycle Management (RCM) Practices: UHG’s robust RCM practices, such as proactive follow-up on unpaid claims and denial management, minimize payment delays. By optimizing each stage of the revenue cycle, UHG ensures quicker payment collection, maintaining lower DSO levels.

Focus on Patient Financial Services: UHG’s emphasis on patient financial services, offering clear billing information and multiple payment options, enhances patient satisfaction and encourages prompt payment. A transparent payment process reduces delays, leading to quicker payment turnaround and lower DSO.

UHG sells stuff faster with 0 inventory days!

UnitedHealth Group (UHG) has perfected inventory management.

Over the past five years, UHG’s Days Inventory Outstanding (DIO) has consistently been 0 days each year, maintaining an average of 0 days from 2019 to 2023.

This efficiency sets UHG apart, minimizing costs and maximizing profitability, making their performance a gold standard in financial management.

How is UHG able to consistently maintain near-zero DIO levels?

Service-Oriented Business Model: UHG operates primarily in the healthcare services and insurance sectors, which inherently involve minimal physical inventory. Unlike manufacturing or retail companies, UHG’s business model revolves around providing services rather than selling physical goods, resulting in naturally low inventory levels.

Outsourcing Non-Core Inventory Functions: UHG strategically outsources non-core inventory functions to specialized vendors like McKesson Corporation, Cardinal Health, AmerisourceBergen, Medline Industries, and Owens & Minor. This allows UHG to focus on its core competencies in healthcare and insurance services, while vendors manage the logistics and inventory for ancillary products, contributing to near-zero DIO levels.

UHG pays its suppliers within 79 days!

UnitedHealth Group (UHG) plays the payment game masterfully.

Over the past five years, UHG’s Days Payable Outstanding (DPO) averaged 79 days.

The yearly figures were 76 days in 2019, 82 days in 2020, 78 days in 2021, and 79 days in both 2022 and 2023.

The industry average DPO is 71 days, indicating that UHG typically takes longer to pay its suppliers compared to the industry norm.

This approach allows UHG to manage its cash flow effectively.

Why does UHG take longer to pay its suppliers?

Complex Regulatory Compliance: UHG operates in a highly regulated healthcare industry, requiring strict adherence to numerous federal and state regulations, such as HIPAA and CMS guidelines. This requires meticulous documentation and verification for each transaction, extending the payment approval process.

High Volume of Claims and Transactions: UHG processes millions of claims annually, equating to thousands of daily transactions. This high volume demands extensive administrative and logistical efforts to ensure accuracy, leading to longer payment cycles compared to the industry norm.

UnitedHealth: The Ringmaster of Financial Wizardry!

In the grand circus of finance, UnitedHealth Group is the ringmaster, dazzling us with its financial acrobatics!

They’ve mastered cash flow judo, turning sales into cash at warp speed and juggling payments with the finesse of a circus performer. Even amid cyber chaos and a $872 million attack, UHG’s resilience is awe-inspiring.

Harnessing advanced billing systems, rock-solid payer relationships, and top-notch revenue cycle management, they’ve kept their DSO impressively low. Their service-oriented model and strategic outsourcing keep inventory days at zero, while savvy supplier payment strategies ensure robust cash flow.

UnitedHealth’s financial acrobatics make them the Cirque du Soleil of the healthcare industry. They’ve set a new standard in financial management, proving that in finance, it’s not about pulling rabbits out of hats—it’s about pulling cash from receivables!

Sources:

Linkedin

Linkedin Facebook

Facebook Twitter

Twitter Copy url

Copy url