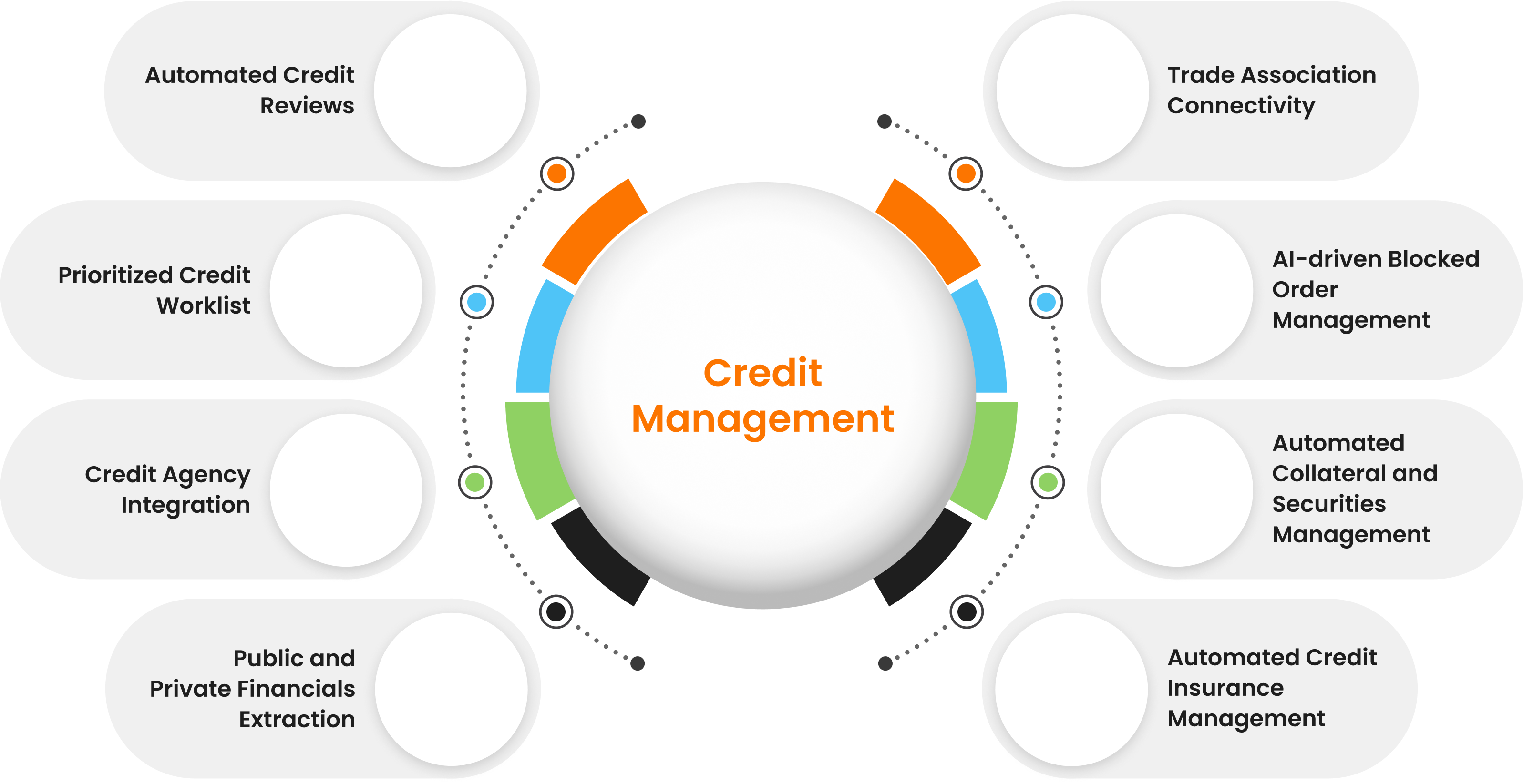

Credit Risk Management

AI-based Credit Review Management

Utilize Automated Algorithms for Continuous Credit Limit Monitoring, Identifying Adjustments Based on Comprehensive Customer Data Analysis.

Utilize Automated Algorithms for Continuous Credit Limit Monitoring, Identifying Adjustments Based on Comprehensive Customer Data Analysis.

Streamline credit limit optimization through comprehensive automated analysis of customer data.

Connect now with our digital transformation expert and get your questions answered live.

Chat live with an expert

Explore other features of the Credit application system